- The Dow Jones Industrial Average declined in its recent trading at the intraday levels, to record losses in its last sessions.

- It fell by by -1.07%, dropping by -337.98 points to settle at the end of the session at 31,318.45.

- During Thursday's trading it rose by 0.46% , to end last week's trading with a decline for the third week in a row, by -2.99%.

- The index had a long weekend to close Wall Street on Monday for the Labor Day holiday.

The index rose at the beginning of the session's trading after data came that indicated that the US economy added about 315,000 jobs in August. An increase by 300,000 jobs were expected by economists. The unemployment rate and the number of people who decided that it's time to start looking for a job increased, while wages have grown at a slower rate which is more than expected and may only be enough to slow the pace of Fed rate hikes. This was the way the stock market initially handled on Friday.

Gains turned into losses as markets appeared to have come to terms with the fact that the labor market was slowing. It rose by over 300,000 new jobs, which is considered strong under most conditions, while wages continue to rise 5.2%. As a result, the door remains wide open for the Fed to continue aggressively, and the possibility of a 75bp rate hike at the September meeting remains on the table.

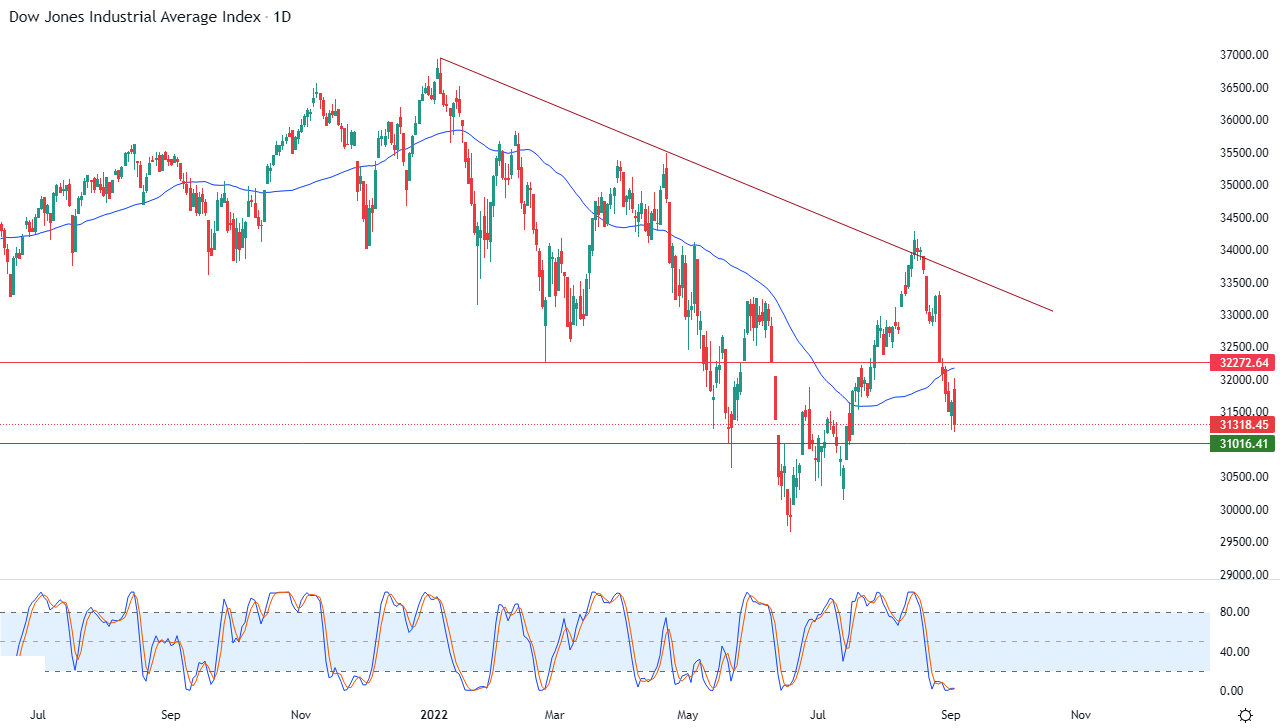

Dow Jones Technical Analysis

Technically, the downward corrective trend dominates the movement of the index in the short term and along a slope line, as shown in the attached chart for a (daily) period. The index has showed relative strength, that is why we witnessed these gains on Thursday and in the early tradings on Friday, but after that it was exposed to negative pressure that forced it to rebound lower.

Therefore, our expectations indicate a further decline for the index during its upcoming trading, as long as the resistance 32,273 remains intact, to target the first major support levels at 31,000 in preparation to break it

Ready to trade our US 30 technical analysis? We’ve made a list of the best online CFD trading brokers worth trading with..

Ready to trade our US 30 technical analysis? We’ve made a list of the best online CFD trading brokers worth trading with..