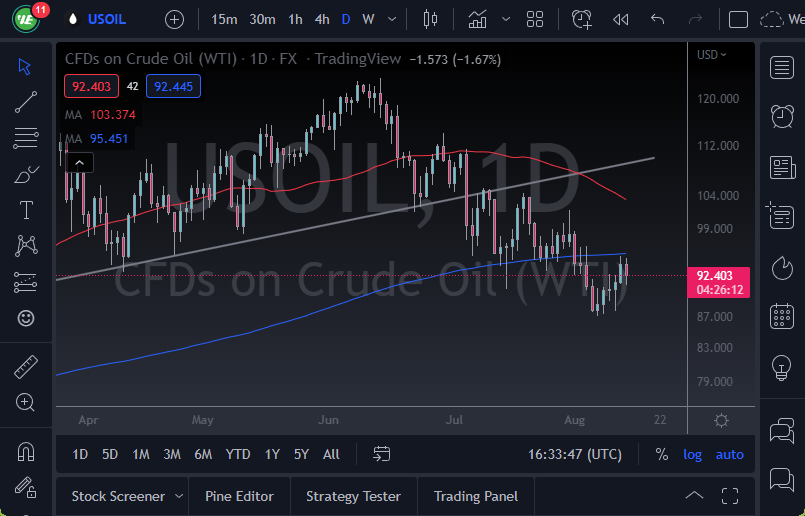

- The West Texas Intermediate Crude Oil market fell a bit on Friday as the 200-day EMA has offered a bit of trouble.

- This is a market that has a lot to digest, due to the fact that the economy is all over the place, as we are starting to factor in the possibility of a slowing situation when it comes to demand.

Sliding Down the Channel

The market will continue to pay attention to the descending channel that we are in, and therefore it’s likely that we will see the market respect that going forward. The market breaking down below the low of the Friday session could open up the possibility of a move down to the $87 level, and it should probably be noted that there is a certain amount of psychology involved in the $90 level as well.

On the other hand, if we turn around and crack above the 200-day EMA, then it’s possible that we could see the market try to make a move towards the 50-day EMA, which would essentially put the market looking at the $103 region. Ultimately, I think this market continues to see a lot of noisy and choppy behavior, but I think the best way to attack this market is to fade rallies, as we continue to see a lot of selling pressure overall.

While we could see a little bit of a rally at this point, the reality is that demand is going to suffer due to the slowing economy around the world. That works against the demand equation, and that probably is the story going forward. Because of this, I have no interest in buying, at least not in the short term, but will keep an eye on growth going forward from a global standpoint. Furthermore, we also need to keep an eye on the US dollar, because it can have a negative correlation to this market as well. Ultimately, I do think that this is a market that is going to be noisy at best, so volatility typically breeds negativity over the longer term. The market breaking down below the lows that we made just a few sessions ago could open up the floodgates to reach down to the $80 level rather quickly. Because of this, I think you need to be very cautious.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.