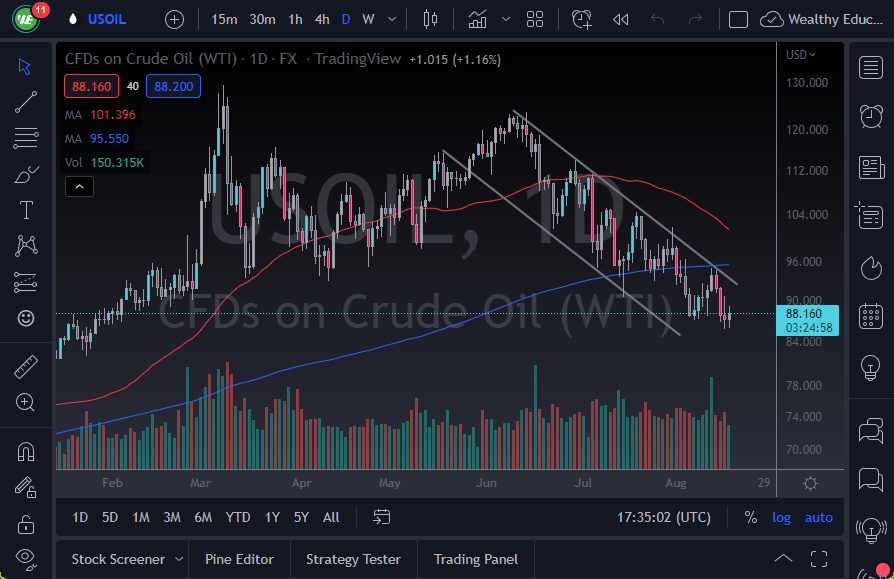

The West Texas Intermediate Crude Oil market has been very negative for a while, and it makes a certain amount of sense that we would see an attempt to turn things background. After all, the market won’t go in one direction forever, and it should be noted that quite a few crosswinds are blowing at the same time.

One of the big negatives out there is the fact that the world economy seems to be slowing down, therefore it should drive down the demand for crude oil. Even with the Russian supply being diverted, the reality is that the market is still trying to price in the fact that demand may fall off a cliff. If this is going to be the case, it’s obvious that the price needs to come back in. The question is whether or not the market has priced everything in so far. That remains to be seen, but we are clearly below the 200 Day EMA, and now below the $90 level.

Crude Oil Forecast

If we break down below the lows of the last couple of days, it’s very likely that this market could drop to the $80 level. Any rally now will struggle to continue going higher, at least not without the fundamentals changing. A bit of a rally from here does make a certain amount of sense though, because if no other reason than the fact that the market has been selling off for quite some time. Remember, markets never go in one direction forever, so it does make a certain amount of sense that we would see an attempt to recover. It looks as if oil is going to continue to struggle not only based on the potential lack of demand, but also the fact that the Iranians are apparently making concessions in order to sell in the global markets as well. If Iran starts to pump crude oil into the global supply chain, that obviously brings more supply and, thereby drives prices down.

- If we were to break above the $100 level, that could kick off the next bullish run in this market.

- It would take quite a bit of momentum shifting in order to make that a reality.

- Rallies will more likely than not offer selling opportunities.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Oil trading brokers in the industry for you.