Spot natural gas prices (CFDS ON NATURAL GAS) declined in the last trading at the intraday levels, to record daily losses until the moment of writing this report, by -2.00%, to settle at the price of $ 7.931 per million British thermal units, after its decline during Friday’s trading by -1.72%. During the past week, natural gas declined by -3.84%, breaking a series of gains that continued for four consecutive weeks.

September gas futures contracts in Nymex settled at $8.064 per million British thermal units, down 5.8 cents on the day. October futures contracts in Nymex were down 6.3 cents at $8.051.

Natural gas futures fell sharply after the latest weather data showed cooler temperatures in the East Coast region of the United States. It would be a welcome respite from the stifling heat that has produced records all summer in an area where steep hikes are more common.

The cooler outlook is helping to cushion the stocks that have fueled higher prices throughout the summer, as demand increases supply, there are concerns that tight stocks and strong demand could lead to a shortage of the commodity this winter.

However, the latest government storage data provided the market with some optimism, as the US Energy Information Administration (EIA) said that stocks for the week ending July 29 increased by 41 billion cubic feet, which is above the levels of the previous year and the five-year average.

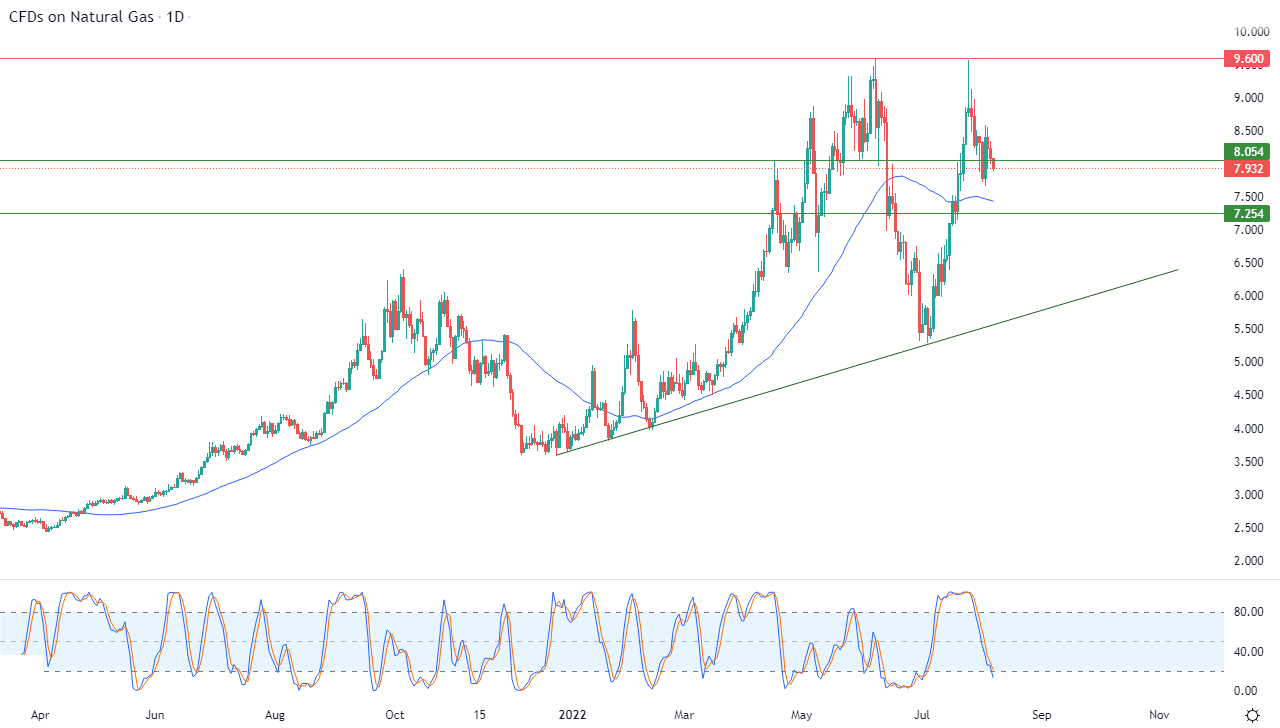

Technical Analysis

Technically, the decline in natural gas comes amid the influx of negative signals on the relative strength indicators, as part of its attempts to search for a bullish bottom. It can take it as a base that might help it gain positive momentum to regain its recovery and rise again. This is in light of the dominance of the main bullish trend in the medium and short term along a slope line. as shown in the attached chart for a (daily) period. The positive pressure of its trading is continuing above its simple moving average for the previous 50 days.

Therefore, our expectations suggest a return to the rise of natural gas during its upcoming trading, but on condition that its stability returns first above the resistance level 8.054, after which it will target the pivotal resistance level 9.600.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity trading brokers worth trading with.