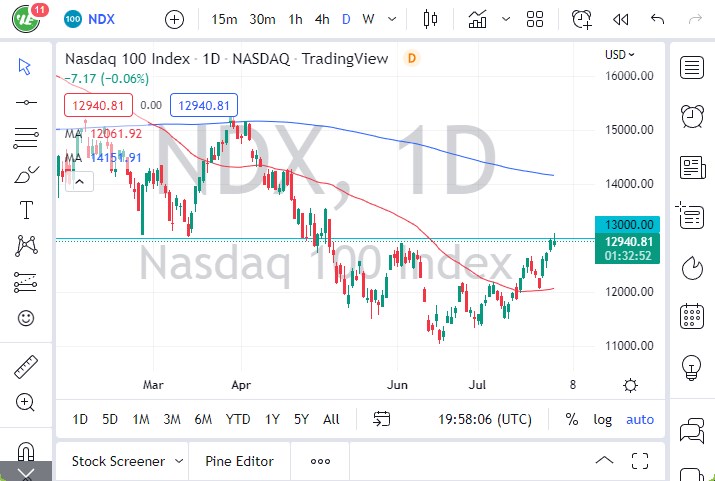

- The NASDAQ 100 trying to break out Monday but seems to be struggling with the idea of breaking above the 13,000 level.

- It was a very choppy and noisy session, as we continue to try to figure out where we are going next.

- There is a big argument right now between the possibility that the Federal Reserve is going to pivot, and what seems to be reality from an inflation basis.

What's Happening with Wall Street?

The Federal Reserve has had a couple of actors come out and suggest that perhaps they are going to continue to tighten, and that should be bad for the NASDAQ. However, Wall Street doesn’t believe this and that makes a certain amount of sense due to the fact that almost everybody on Wall Street has yet to trade an inflationary environment. Keep in mind that the average money manager wasn’t even around during the Great Financial Crisis. In other words, this is all new to them, and they’ve been raised to believe that the Federal Reserve will do whatever it takes to save them.

Whether or not that ends up being the case is a completely different question, but this is a major problem that the Federal Reserve itself has created. After all, you cannot continually bail out Wall Street and expect them to behave any differently. In that vein, it’s worth noting that the market is doing what it’s always done, trying to front-run what the Federal Reserve may do to save them. The real question is whether or not they know how to deal with the economy itself. The economy and the stock market have become so far from the reality of each other that if we actually traded based upon fundamentals, it’s kind of scary where we may end up.

That being said, this is the market that we are stuck with, so it’s all about monetary flow. It’s not about earnings, it’s not about the health of the economy, it’s about free and cheap money for Wall Street. If they have it, then it’s a party. However, if they do not have it, then we sell off. It’s been that simple for 13 years, and I don’t know that it changes anytime soon. We are essentially watching a game of “chicken” being played out between Wall Street and the Federal Reserve.

Ready to trade our NASDAQ 100 forecast? Here’s a list of some of the best CFD trading brokers to check out.