For two days in a row, the price of gold is trying to recover. The rebound gains did not exceed the resistance level of 1756 dollars an ounce, before the price of XAU/USD settled around the level of 1751 dollars an ounce in the beginning of trading today, Thursday. Attempts to recover the gold price were halted by the strength of the US dollar and with investors' focus turned to the global central banks event in Jackson Hole to get more clues on interest rate hike plans.

The US dollar rose 0.3%, making gold more expensive for overseas buyers.

While a stronger dollar is hurting gold, the market is relatively calm. Commenting on this, Bob Haberkorn, chief market analyst at RGO Futures, said metal traders are waiting to see what comes out of the Jackson Hole meeting and want to know more about the Fed's rate hike path. Market participants await US Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Economic Policy Symposium on Friday. The speech may shed some light on the path of Fed monetary tightening.

Amid high interest rates, gold tends to underperform because it does not generate any interest. In general, the price of gold is rising due to the decline in the dollar after the weak US data.

Investors will also focus on the second estimate of US GDP for the second quarter and consumer spending data for July which is due for release later this week.

Spot silver was down 1% to $18.97 an ounce. Commenting on the performance, Carlo Alberto de Casa, analyst at Kinesis Money said, “Silver’s price performance has been negative so far in 2022… A combination of negative factors, including fear of recession, rising interest rates and a strong dollar, have severely impacted the price of the industrial metal.”

XAU/USD Gold Price Analysis Today

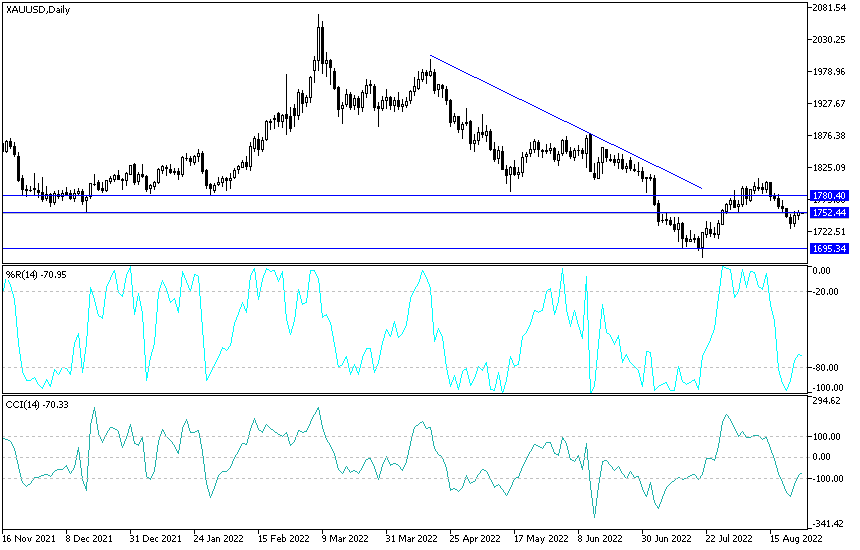

- There is no change in my technical view for the performance of the XAU/USD gold price.

- The trend is facing downward pressures, and the direction will not change to an upward trend without stabilizing above the psychological resistance of 1800 dollars an ounce.

- I still see that the price of gold may move in narrow ranges and tighten performance until the reaction to the most important event for the markets this week, the statements of US Central Bank Governor Jerome Powell in his Jackson Hole seminar.

I still prefer buying gold from every bearish level and the closest support levels for gold are currently 1742 and 1725 dollars, respectively. The XAU/USD gold price will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the announcement of the growth of the US economy and the number of US weekly jobless claims.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.