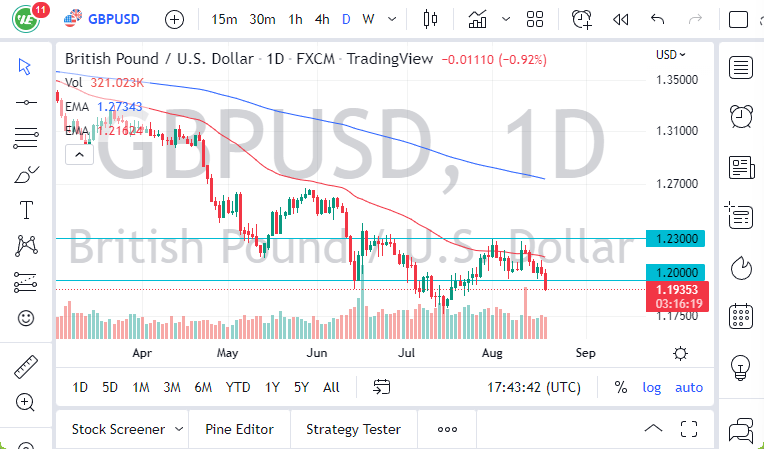

The GBP/USD currency pair has fallen again during trading on Thursday as we continue to see a lot of negativity when it comes to anything against the US dollar. Whether or not the British pound breaks down to a fresh, new low is a completely different story, but the fact that we have broken through the 1.20 level is of course an event worth paying attention to.

- Short-term rallies will almost certainly be selling opportunities in the market that has been negative for a while.

- We are more likely than not going to see a lot of noisy behavior, as choppiness has been one of the biggest problems in markets overall.

- As long as this is going to be the case, you need to be cautious with your position size as there has been a lot to chew through over the last several weeks.

Bank of England VS Federal Reserve

After all, the Bank of England has stated that they fully anticipate that the British economy is about to head into a recession. At the same time, there are a lot of questions as to whether or not the Federal Reserve is going to continue tightening at the pace they have been, which obviously would have a major influence on where things go next. Either way, we are in a downtrend so I don’t think there’s any reason to change the approach, as it is still a market that you are looking to fade on rallies. Furthermore, the 50 Day EMA above is more likely than not going to offer a bit of dynamic resistance, so it’s probably worth noting that area as a potential ceiling. If we do break down below the 1.18 level, it’s likely that we can look towards 1.16 level next. Ultimately, the only thing I think you can count on is a lot of noise, but that’s the same thing that you could have said about the last several weeks.

The US dollar is still the world’s favorite currency at the moment, so that’s the one thing that you need to keep in the back of your mind. It’s not until we break above the 1.25 level that I would consider going long of the British pound, even though we are pretty long in the tooth when it comes to this downtrend.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.