The EUR/USD will decline significantly in 2022. While factors such as the US economy and Fed policy have been a significant driver of this decline, it is the rising cost of energy supply disruptions that is giving most confidence to some other markets, which implies the eventual collapse of the euro.

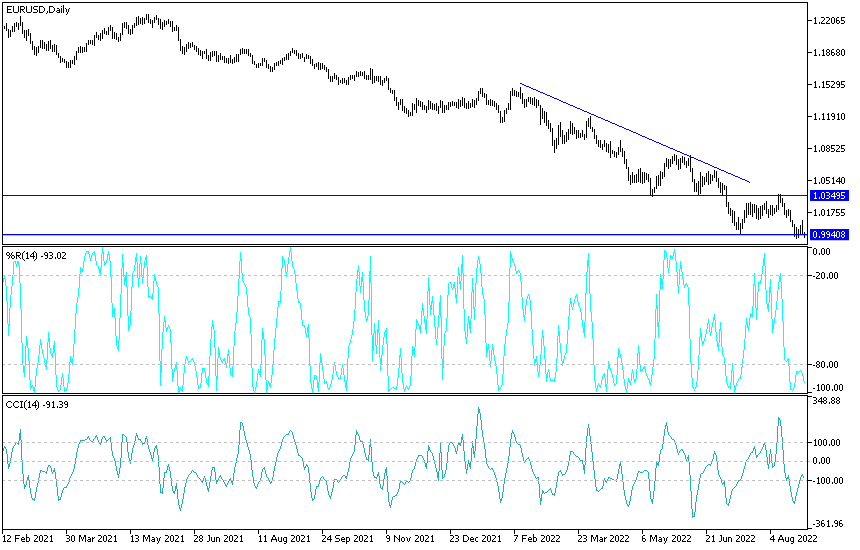

The EUR/USD currency pair against the dollar EUR/USD fell last week to the 0.9900 support level, its lowest in 20 years, and in reaction to Jerome Powell's statements, he tried to recover on Friday to the 1.0090 resistance, but he returned in his strongest downward path towards the 0.9964 support level and closed trading around it.

The euro gained a respite for most of the last week after falling below parity with the dollar during Monday's session, but European gas prices remained at high levels after days of massive increases. These costs and their expected impact on companies and households alike is what prompts some forecasters to feel confident that the fall of the euro for more than 18 months may still have a long way to go.

The price of electricity in Germany will increase over the next year by more than 1000 US dollars in terms of Brent oil energy equivalent. This is far from normal, and so says Jordan Rochester, the expert at Nomura: "It is a crisis that does not only stem from the restricted energy supplies from Russia, but a series of unfortunate issues."

In addition to energy constraints, the Eurozone faces the brunt of climate change with record-breaking flash floods and droughts, as well as slowing trade with China and the risk of a recession in the United States. However, we believe that the biggest challenge that Europe will face this winter is not inflation, but inflation accompanied by recession.

"This is why we expect the EUR/USD to drop to the 0.90 support this winter," added Rochester.

European gas prices have more than doubled over the past week after the Russian gas monopoly said it would halt supplies through a key pipeline for three days in September, adding pressure on an already tight market. It is likely that the economic burdens created by these price increases will remain a headwind for the single European currency in the absence of credible supply-side responses from European countries to the ongoing Russian gas diplomacy.

"These incomprehensible price increases add pressure on European leaders to find a solution to the unfolding energy crisis that will put pressure on many families," said Bas Van Giffen, chief economic analyst at Rabobank.

At the same time, American families are struggling to pay their utility bills. However, this situation pales in comparison to the rising prices faced by European consumers.

The rising cost of European energy supplies has driven deep declines in many financial model-derived estimates of the single currency's fair value this year, and with little respite on the horizon, some of the market's most bearish forecasters are feeling upbeat about their EUR/USD outlook.

Both Rabobank and Nomura have predicted a sustained break without parity in the EUR/USD rate over the coming months. According to their forecasts, the EUR/USD is likely to fall to 0.90 this winter with a terms of trade shock pointing to 1980s levels at 0.65 as a possibility.

Expectations of the EUR/USD:

- In the near term and according to the performance on the hourly chart, it seems that the EUR/USD currency pair is trading within the formation of an ascending channel. This indicates a slight upward trend in the short term in market sentiment.

- Therefore, the bulls will target short-term profits at around 1.0039 or higher at 1.0083. On the other hand, bears will look to pounce on possible pullbacks around 0.9963, or lower at 0.9913.

- In the long term and according to the performance on today's chart, it seems that the EUR/USD currency pair is trading within the formation of a descending channel. This points to a significant long-term downward wound in market sentiment.

- Therefore, bearish speculators will look to extend the current path of declines towards 0.9810 or lower to 0.9612. On the other hand, the bulls will target rebound profits at around 1.0182 or higher at the 1.03 level.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.