- The Dow Jones Industrial Average closed with a rise in its recent trading at the intraday levels, to break its longest losing series in a month.

- It achieved gains in its last sessions by 0.18%, to gain about 59.64 points.

- It settled at the end of trading at the price of 32,969.24, after its decline in the day’s trading. Tuesday and for the third consecutive session, a rate of -0.47%.

18 of the index's 30 components advanced, with Salesforce Inc. increased by 2.28%, before the company reported diluted earnings for its fiscal second quarter late Wednesday of $1.19, down from $1.48 a year earlier. Revenue was $7.72 billion in the quarter ended July 31, up from $6.34 billion a year earlier.

Dow Jones Economic Data

New orders for durable goods held steady in July after rising 2.2% in June, missing expectations for a 0.8% increase in a Bloomberg survey.

While the National Association of Realtors' pending home sales index fell 1% in July, a smaller-than-expected gain, pending sales fell nearly 20% from a year earlier.

Investors are now focused on the Jackson Hole symposium that begins Thursday, with a speech from Federal Reserve Chairman Jerome Powell on Friday likely to provide more clues about the pace of future rate hikes, and whether the central bank can achieve a "soft landing" for the economy.

Technical Outlook

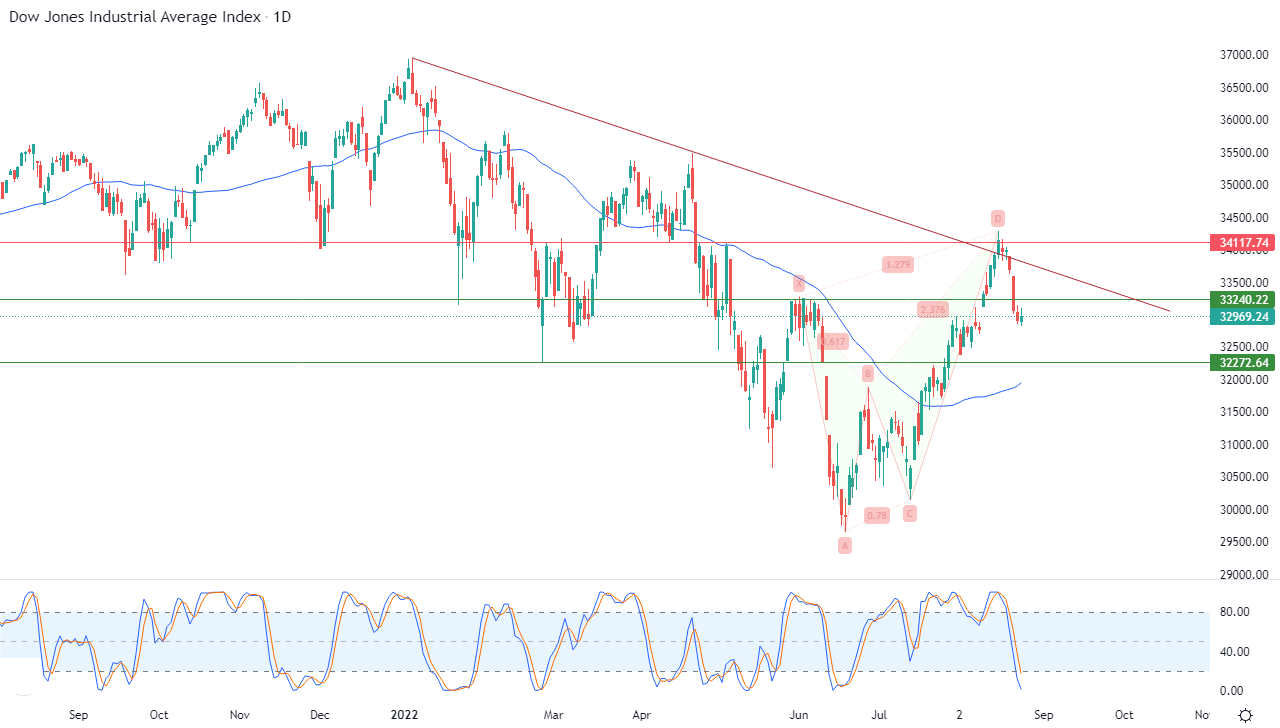

Technically, the index with its recent rise is trying to compensate for part of what it incurred from previous losses. Att the same time it is trying to discharge some of its clear oversold by the relative strength indicators. This is in light of the stability of its trading below the level of 33,240, and under the control of the bearish trend in the medium term along a slope line. You can see this in the attached chart for a period of time (daily). In front of these negative pressures, we find it moving above its simple moving average for the previous 50 days, which gives it some positive momentum.

Therefore, our expectations suggest a return to the index's decline during its upcoming trading, especially throughout its stability below the resistance level 33,240, to target the support level 32,272.65.

Ready to trade the Dow Jones in Forex? Here’s a list of some of the best CFD brokers to check out.