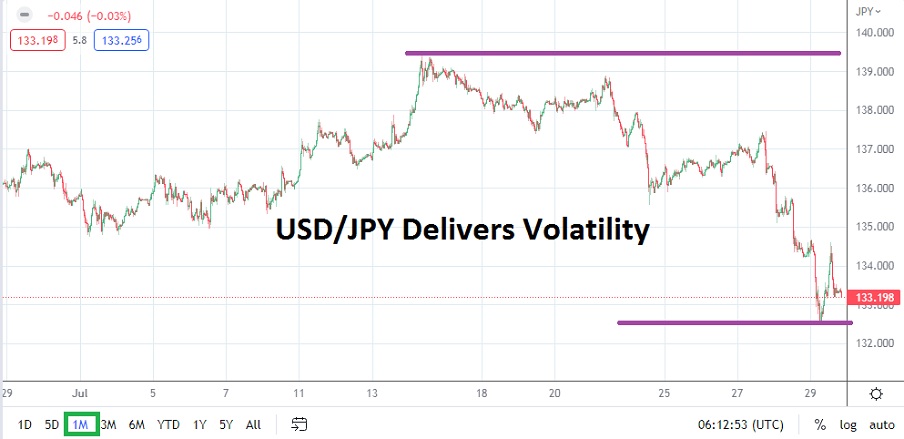

August promises to be a speculative playground for USD/JPY traders. And as children and their parents know, it is best to use playgrounds carefully and not be reckless. A vast amount of volatility was delivered by the USD/JPY currency pair during July. A high of nearly 139.500 was displayed on the 14th of July, a mark not seen since September of 1998. A low for the USD/JPY occurred this past Friday, the 29th of July when the Forex pair touched approximately 132.500, which is a value that had last been seen on 17th of June. Precautions are important via risk taking tactics.

Choppy and fast conditions were a guarantee taking into consideration the bullish trend the USD/JPY has been pursuing the past handful of months, and the knowledge the U.S Federal Reserve was going to undertake an additional interest rate hike this past Wednesday. But what wasn’t known was the exact trajectory, nor the reactions by financial institutions. Retail traders who were hoping to catch movements perhaps found more than they bargained for as they wagered.

Bank of Japan Stays Relatively Quiet while U.S Fed Stays Hawkish

Technical traders may claim they saw the sudden downturn coming, which started to be generated it can be argued on the 14th of July after reaching the apex high. However, trading conditions the past two weeks of July to finish the month saw sharp reversals, and traders not using stop loss and take profit orders may have felt more pain than pleasure. A true downward spike lower happened this past handful of days. On the 27th of July the USD/JPY recovered upwards to about the 137.450, but then began a steady decline. As the month of August gets set to begin, day traders have plenty of decisions to make.

- Interest rate differential between USD and JPY has grown considerably, but financial institutions also need to consider economic outlook.

- Technical charts remain challenging and support levels should be studied carefully for volatility as they continue to be tested.

- USD/JPY showed the ability to come off highs and produce a solid reversal lower, but will the price action be sustained?

Economic Outlooks Remain Challenging for Japan and U.S

The sudden and swift downward movement of the USD/JPY was strong the past couple of days going into the weekend, and the results were not surprising. When the USD/JPY moves quickly it has the ability to take no prisoners and fly through support levels, just like it can jump past resistance ratios with relative ease sometimes. Economic and central bank policies via the Bank of Japan and U.S Federal Reserve remain unclear. Political decisions will certainly affect economic policy decisions from both central banks, and that may not be particularly good decisions for the public.

USD/JPY Outlook for August 2022

Speculative price range for USD/JPY is 129.100 to 137.900

The 132.000 support level will produce a quick insight for day traders when the USD/JPY starts trading in August. After swift moves downward the past two days, traders will want to see if momentum continues or a sudden reversal higher occurs. If the 132.000 should falter and the 131.750 to 131.250 vicinities find they are being challenged as the month begins, this could open the door for the consideration that many view the USD/JPY as remaining overbought.

However, skeptics taking into consideration that economic clarity remains murky may believe the higher range of the USD/JPY is still worthwhile and should be speculated on, which means they may use support levels to initiate long positions and seek moves upward. If the 131.000 level were to suddenly be tested, the 130.000 level may find durable support. The notion that the USD/JPY could sink to the lower depths does seem difficult to imagine, but it should be remembered the Forex pair was trading near 129.100 on the 1st of June, which is not so long ago.

If economic numbers remain perplexing from the U.S and data like inflation continues to show it is troubling in things like core consumer products, the USD/JPY from a fundamental perspective may remain near its higher values. While many may believe the worst is over via inflation data, surprises are still possible particularly if energy prices remain inflated.

The USD/JPY may not challenge its apex highs seen in July, but moves which retest the 133.000 to 134.000 levels should not be unexpected and perhaps higher. Traders are cautioned to use risk management during the month of August, which is a month traditionally when trading volumes decrease slightly because of holidays among workers in the financial industry being taken, meaning volatility can sometimes happen when it is least expected.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.