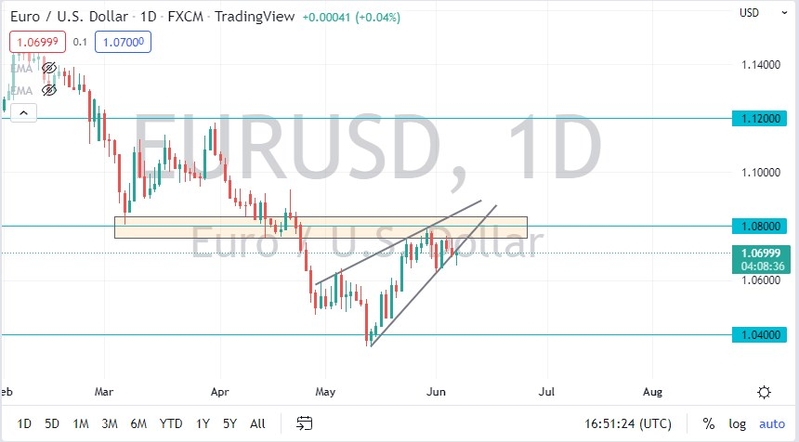

The Euro has broken down during the trading session on Tuesday to break through a short-term uptrend line. You can make an argument that we have pierced the bottom of a rising wedge, but it’s also worth noting that the market did a lot of recovery later in the day. In other words, we are still spinning our wheels and trying to figure out where we go next.

With inflation numbers in America coming out on Friday, it could very well be a situation where we are going to kill time between now and then. I certainly know that the market has been choppy enough to make it feel like that. If we do rally from here, the 1.08 level is a significant amount of resistance, as it was previous support. We also have the 50 Day EMA just about, and that will more likely than not show quite a bit of noise as it typically does.

If we were to break down through the bottom of the candlestick, then we could go looking to reach the 1.06 level, possibly even down to the 1.04 level, which would be a fulfillment of the measured move of the rising wedge. Breaking below the 1.04 level opens up the possibility of a move down to the 1.02 level, followed by parity. A lot of pundits do believe that the Euro will eventually go to parity, but it’s obvious that we are fighting to see that happen.

Interest rates will drive everything, and at this point, some traders are starting to think that the European Central Bank will have to become a bit more aggressive with its monetary policy, due to inflation in the continent. However, the Europeans also have a growth problem, so it’s a much more complex situation than the very complex situation in the United States. In a situation where we will more likely than not continue to see a lot of concern, it also makes sense that the US dollar would be favored. We are in a downtrend, so I have to assume that the sellers will continue to come back into the picture. However, if we were to break above the 1.09 level, then we may make a move to reach the 200 Day EMA, which is at roughly 1.1140 at the moment.