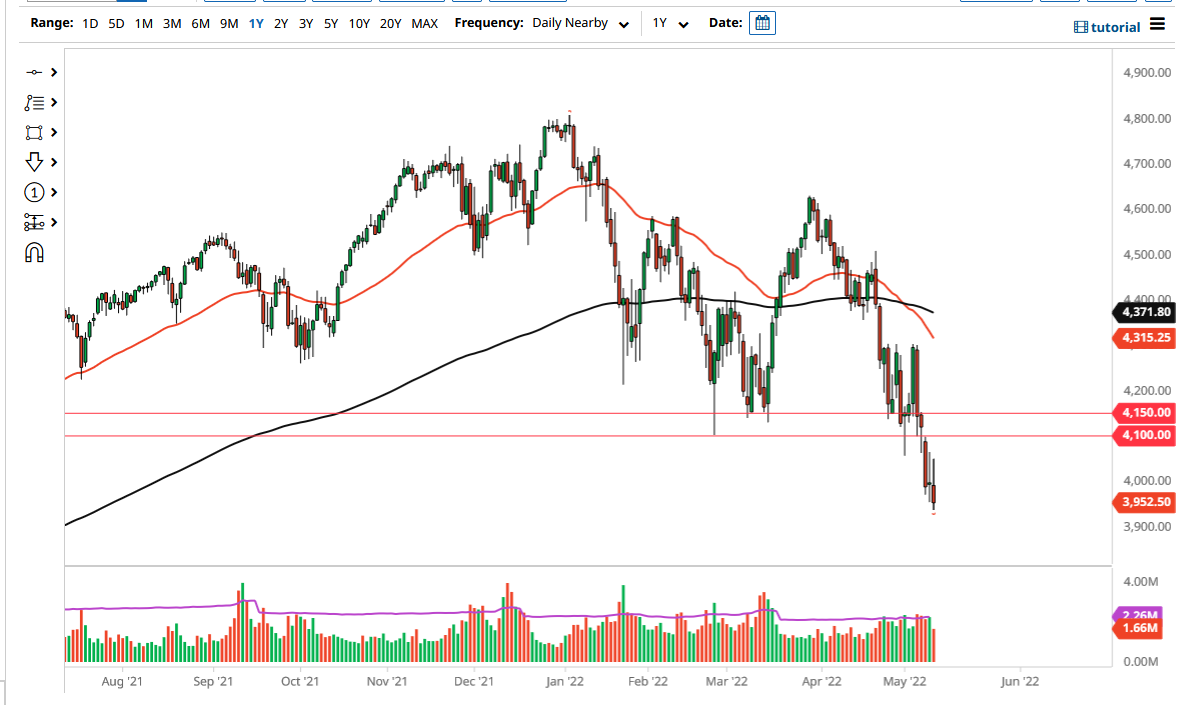

The S&P 500 initially rallied on Wednesday, but the stronger than anticipated CPI numbers had a lot of volatility entering the market. Because of this, the market has given up a lot of the gains at the end of the day, as it looks like we are continuing the trend of expecting the Federal Reserve to become extraordinarily tight. There are a lot of other concerns out there, of course, so it should not be a huge surprise to see what has happened.

The market did break above the 4000 level at one point, but you can see we have closed well below there. In fact, the candlestick ended up being an inverted hammer, which suggests that we are going to continue to see a lot of negativity. At this point, the 3900 level is more likely than not going to be targeted, and if we can break through there, it is likely that we have yet another leg lower. At that point, I would anticipate a lot of momentum entering the market, and a massive and nasty selloff being the norm.

Rallies at this point in time should be selling opportunities, as we will continue to see a lot of concern out there when it comes to the attitude of the market due to inflation, a tightening Federal Reserve, and the recession that is almost certainly coming down the road. Because of this, think the markets will be very hesitant to become “risk-on” going forward. Any rally at this point in time should be a nice selling opportunity, and I think that is how you have to look at this market: one that will continue to be shorted occasionally. It should be noted that the market breaking down below the bottom of the range from the previous session and closing at the very bottom of the candlestick does, in fact, suggest that we are going to continue seeing a lot of negativity that will see a certain amount of follow-through. Typically, when you close at the very bottom of a range, sellers are going to show up during the next session as well. At this point, it would take some type of major shift by the Federal Reserve for me to start thinking about buying this market.