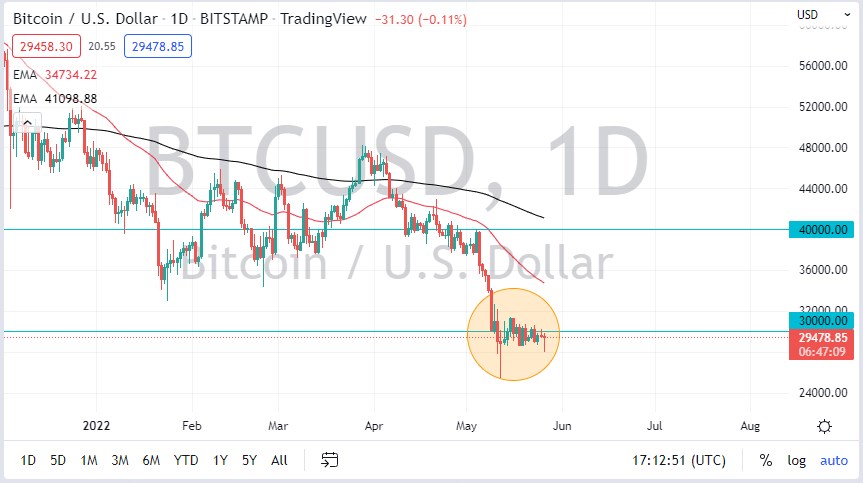

Bitcoin initially fell during the trading session on Thursday, reaching down toward the $28,000 level. However, we have found the buyers as the market picked up a little bit of momentum, forming a bit of a hammer for the daily candlestick. This does suggest that the market is going to try to continue building a bit of a base in this area, but we have a long way to go before this suddenly becomes a bullish market.

Quite frankly, the crypto markets are a bit of a mess right now, and although Bitcoin is most certainly the leader, there are a lot of concerns when it comes to crypto as fraud is being exposed. In fact, there are quite a few “stable coins” that are suddenly being challenged. In this scenario, it’s difficult to imagine that the Bitcoin market is suddenly going to take off. In fact, I anticipate that there is quite a bit of selling pressure out there just waiting to happen. I think at this point it would only take one truly negative fundamental issue to send fresh selling into the market.

That being said, as long as we can stay above the top of the hammer from a couple of weeks ago in the circle on the chart, we at least have a chance to stabilize, if not even build a base. However, if we were to break down below there, this is a market that could fall apart rather rapidly. In that scenario, I would keep an eye on $25,000, and then eventually $20,000.

Bitcoin is something that a lot of people believe in longer-term, but it still does not have a use. I know there’s an argument for all of the uses that it could be, but it has not truly found its footing for the longer term. It was supposed to be a hedge for inflation, which is something that has clearly been exposed as false. At one point it was going to be money, and then it became a store of value. However, a store of value doesn’t lose 50% in a handful of months. We are still early when it comes to Bitcoin, and I do think that eventually there will be some type of use for it, but right now it would not surprise me at all to see this market fall even further, perhaps going into “crypto winter.”