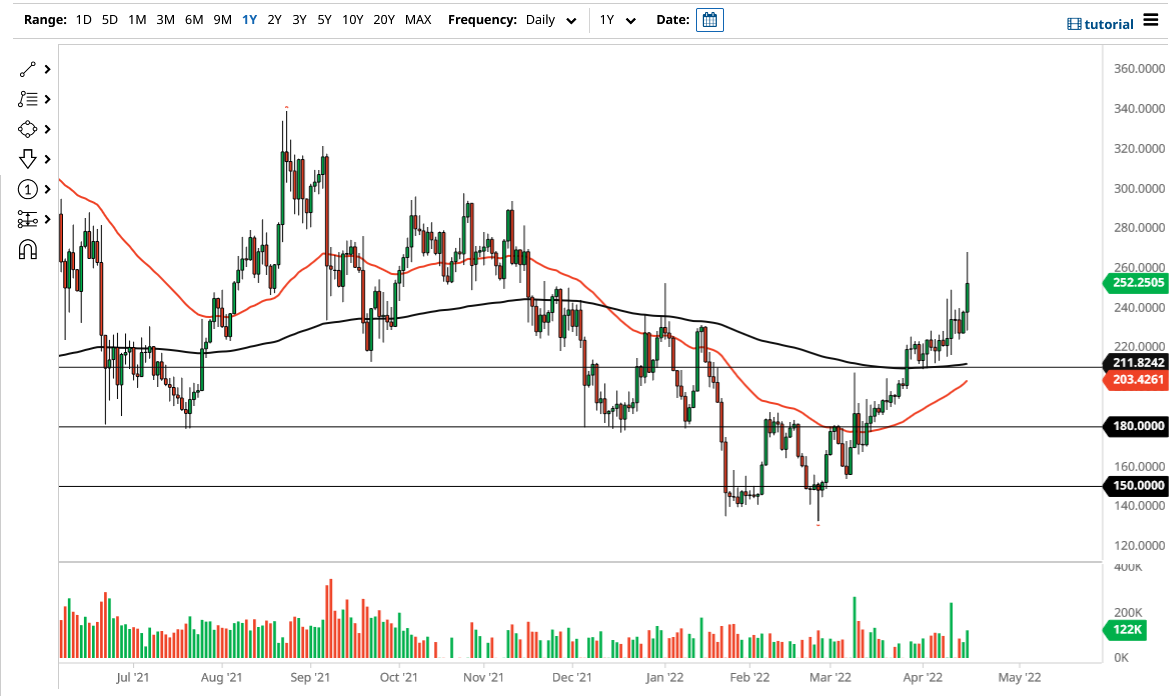

Monero has broken higher during the trading session on Monday, as Monero continues to buck the overall trend. While most of the crypto markets have been struggling to bit, Monero has rallied quite significantly. The candlestick reached the $260 level before pulling back a bit. That does make a certain amount of sense that we would see after a move like this, but the $240 level underneath could be a bit of support.

The candlestick for the trading session on Monday had a larger range than most of the candlesticks before them, so I do think it suggests that we are going to do everything we can to continue going higher. With this being the case, the dips are thought of as buying opportunities, with the $240 level being an obvious start. After that, the market then has to pay close it takes into the $210 level, right where the 200 Day EMA is currently trading.

On the upside, if we were to break above the top of the candlestick for the trading session on Monday, then it is likely that we go looking to the $280 level, maybe even the $300 level after that. This is a market that I think will continue to find plenty of buyers every time we pull back at this point.

It is not until we break down below the $210 level that I would consider selling Monero, especially if Bitcoin and Ethereum are both selling off. At that point, the market is very likely to see an overall selloff in most crypto markets. That would be especially interesting here, due to the Monero market being different than some of the other markets.

The Monero market has been rallying quite significantly after forming that massive “double bottom” at the $150 level, which is a large, round, psychologically significant figure, and of course, an area that has offered quite a bit of trading action in both directions. Regardless, this is a market that I think continues to find plenty of buyers on dips, and I will look at this as a market in which you need to find opportunities and signs of support to get involved. Ultimately, the 50 Day EMA is also getting rather close to the 200 Day EMA, perhaps getting ready to form the so-called "golden cross".