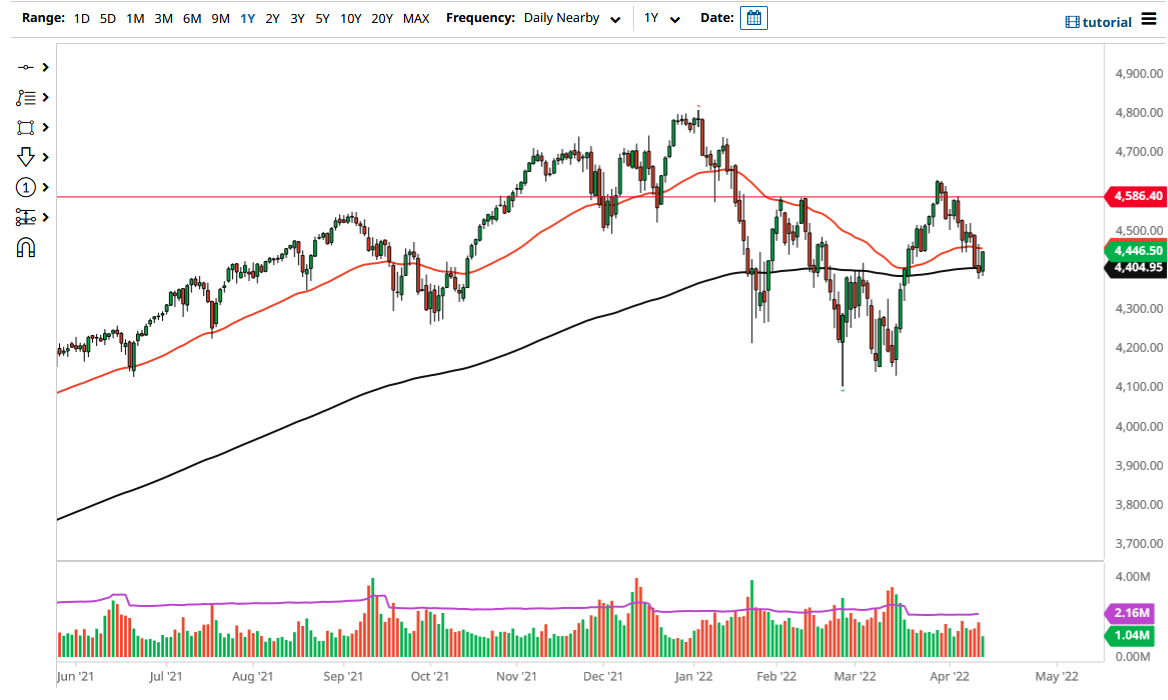

The S&P 500 futures markets have rallied quite significantly on Wednesday to reach the 50-day EMA indicator. If we can break above here, then it is possible that the S&P 500 futures will go looking towards the 4500 level, and perhaps turn things around completely. What will be interesting on that move is that we would be in the process of creating a huge “inverted head and shoulders.”

That being said, there are a lot of things right now that are pointing towards a lower stock market, at least from a fundamental standpoint. If we break down below the inverted hammer from the trading session on Tuesday, then the market will more than likely fall apart, reaching down to the 4300 level, followed by the 4200 level. With the Federal Reserve looking to tighten, is very likely that we will continue to see a lot of negativity, as the recession that is coming will certainly be negative for the markets.

I think the only thing you can count on in the short term is a lot of volatility, and I do think that the fact that we closed at the top of the candlestick for the session does suggest that perhaps we will at least make an attempt to follow through on the upside just a bit. That being said, I still am not quite ready to be a buyer until we break above the 4500 level, and we still have a way to go before that happens. Even then, we need to get above the 4585 level to really kick things off.

I still believe that it is easier to fall at this point, but we will need to simply follow the market and what it does. The breaking of the inverted hammer from the Tuesday session is what I am looking for, so until that happens, I am not necessarily ready to get short either. Typically, when you are stuck between the 50-day EMA and the 200-day EMA, you see inertia build up and a bigger move just waiting to happen. I am going to wait to see some type of impulsive candlestick to follow, especially as it breaks through some of the levels that I had been talking about. I will use a daily close to make my next trading decision.