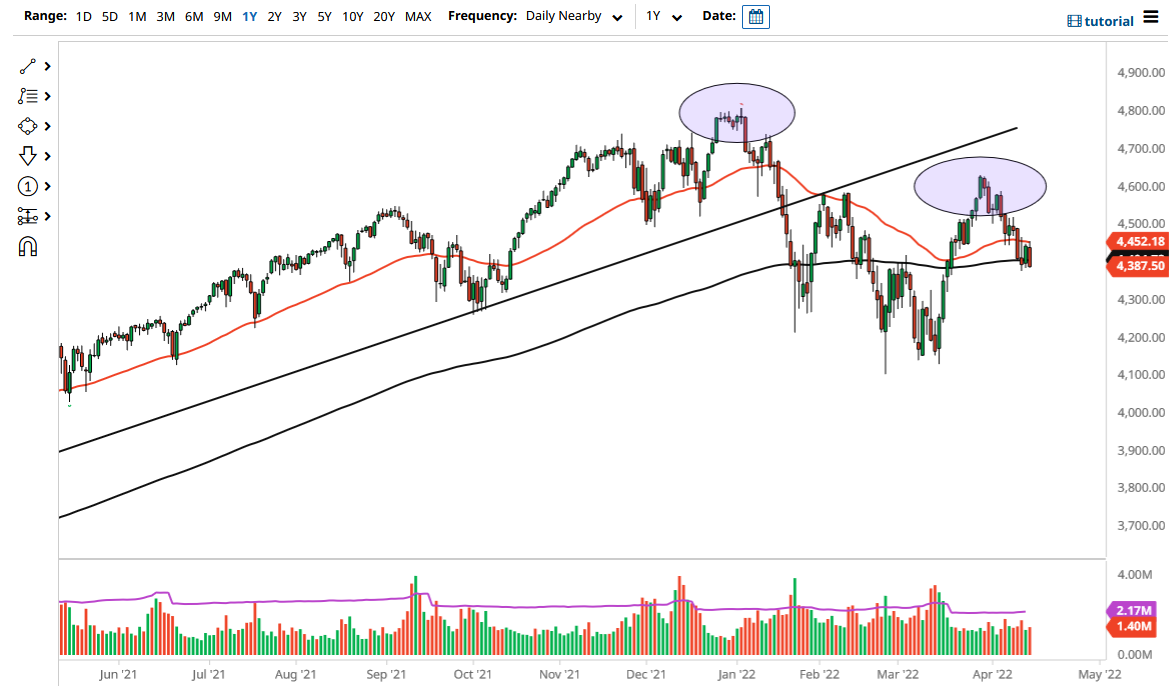

The S&P 500 was rather range-bound during the previous several sessions, but with Good Friday closing down the underlying index, there were just a few hours of electronic trading available. When you look at the CFD markets, they did very little as well but seem very comfortable at the bottom of the overall range. Because of this, I anticipate that when traders get back to work, they will try to figure out where the volatility is leading us.

If we break down below the inverted hammer on Tuesday, it could open up a move to the downside, perhaps reaching down to the 4300 level, and then the 4200 level. At this point, you should also pay close attention to the prospect of inflation weighing upon what the S&P 500 can do, not to mention that the Federal Reserve will continue to play a major part on which traders will base their decisions. Currently, we have a huge argument between the bond market and Wall Street as to where interest rates are going, as it seems like Wall Street is convinced that the Federal Reserve will save them while ignoring inflation. That being said, the market is very likely to continue to wrestle with this question.

For the last 14 years, the Federal Reserve has come into the picture to save Wall Street traders, but we recently have had a significant 8% inflation print, so the Federal Reserve is likely to fight in the name of Main Street. Wall Street of course will be disappointed, and we have an entire generation of traders that have no idea how to trade in a high interest-rate environment, so I think there is a significant amount of risk out there, to say the least.

Furthermore, interest rates do continue to climb in the bond market, so sooner or later somebody’s going to have to give. Whether it is the bond market or the stock market remains to be seen, but typically the bond market does win the argument, though that is not always the case. The recent pullback has certainly seen a lot of negativity in the market, and it is very possible we may see a return to that right away. If we do turn around and rally, we need to break out above the 4500 level to show enough momentum for me to start looking to the upside again.