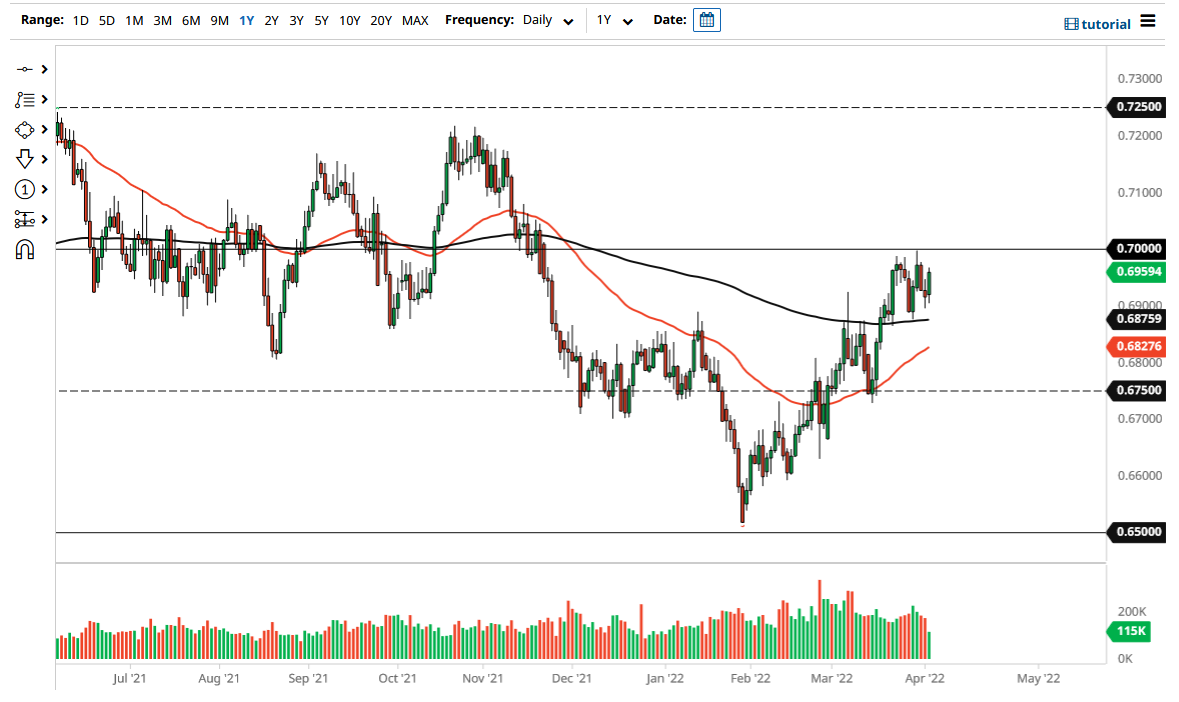

The New Zealand dollar has rallied a bit during the trading session on Monday again, as we continue to consolidate below the 0.70 level to show signs of building pressure, but not quite enough momentum to continue going higher. Because of this, it looks as if the New Zealand dollar is currently “stuck” between the crucial big figure, and the 200 Day EMA, currently sitting at the 0.6875 level.

The New Zealand dollar is especially interesting, due to the fact that the market has a high correlation to certain agricultural items. Anybody who has been watching the futures markets understand that grains have done quite well, and this has had a bit of a “knock-on effect” on the New Zealand dollar. As agricultural commodities continue to find plenty of momentum, the New Zealand dollar could do so as well. However, we need to break above the 0.70 level to get any real momentum going, as it is a psychological and structural barrier.

If we were to break down below the 200 Day EMA, it is possible that we could break down even further, but it is worth noting that the 50 Day EMA is at the 0.6827 handle and moving higher. If we were to break through all of that, then I anticipate that the next move would be to reach down to the 0.6750 level.

On the upside, if we were to break above the 0.70 level, it opens up fresh buying, perhaps sending the market to the 0.71 handle, perhaps even the 0.7250 level above there, as we have seen in the past. The market continues to see a lot of noisy behavior, but ultimately it looks as if we are trying to build up enough momentum to finally break out of this short-term range that we are currently stuck in. The market breaking out of this area is ready to make a bigger move, but at this point we are killing time, perhaps trying to figure out who will win. I think this is a market that is most certainly worth paying attention to, because we are about to see a huge move in one direction or the other, depending on where the next impulsive candlestick points us. It looks as if we are building the inertia necessary for the next leg higher, or a pullback.