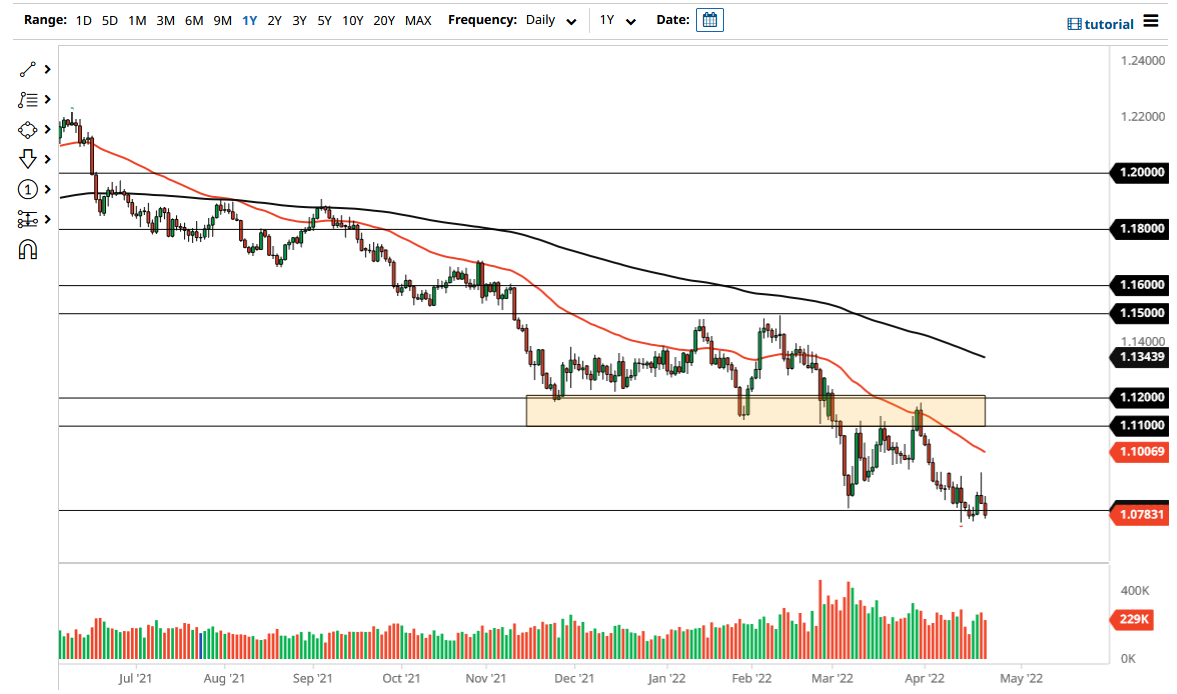

The euro fell a bit on Friday after initially trying to rally but then broke down to reach below the 1.08 level again. The 1.08 level is an area that extends down to the 1.06 level, as there is a lot of noise in that area historically speaking. I think that the market is going to continue to grind lower, but the keyword here of course is going to be “grinding.”

Looking at the Thursday candlestick, the market had initially tried to break out to the upside but then turned around to form a massive shooting star. The shooting star is a negative candlestick, and it shows just how much negative pressure there is out there. If we break down below the most recent low point, the market will likely continue the slow grind towards the 1.06 handle over the longer term.

If we did turn around and take out the top of the shooting star from the Thursday candlestick, then it is possible that we could break to reach the 50-day EMA. The 50-day EMA is sitting at the 1.10 level, which is a large, round, psychologically significant figure that will attract a lot of attention. It is also sloping lower, so it does suggest that we are going to continue to go lower based on the trend indicator itself.

As far as buying the euro is concerned, it is difficult to imagine doing so until we break above the 1.12 level. If we can break above there, then it is likely that the market could go much higher and at that point, I would probably start building a longer-term “buy-and-hold” type of situation. This does not look likely to happen anytime soon, and the fundamental analysis certainly does not line up with that type of move either. The European Central Bank is stuck in a situation where although there is inflation, there is no growth. The Federal Reserve has already stated that they are going to be aggressive with their monetary tightening, so it makes sense that we will see this downtrend play out. The US dollar is like a wrecking ball to almost everything it touches.