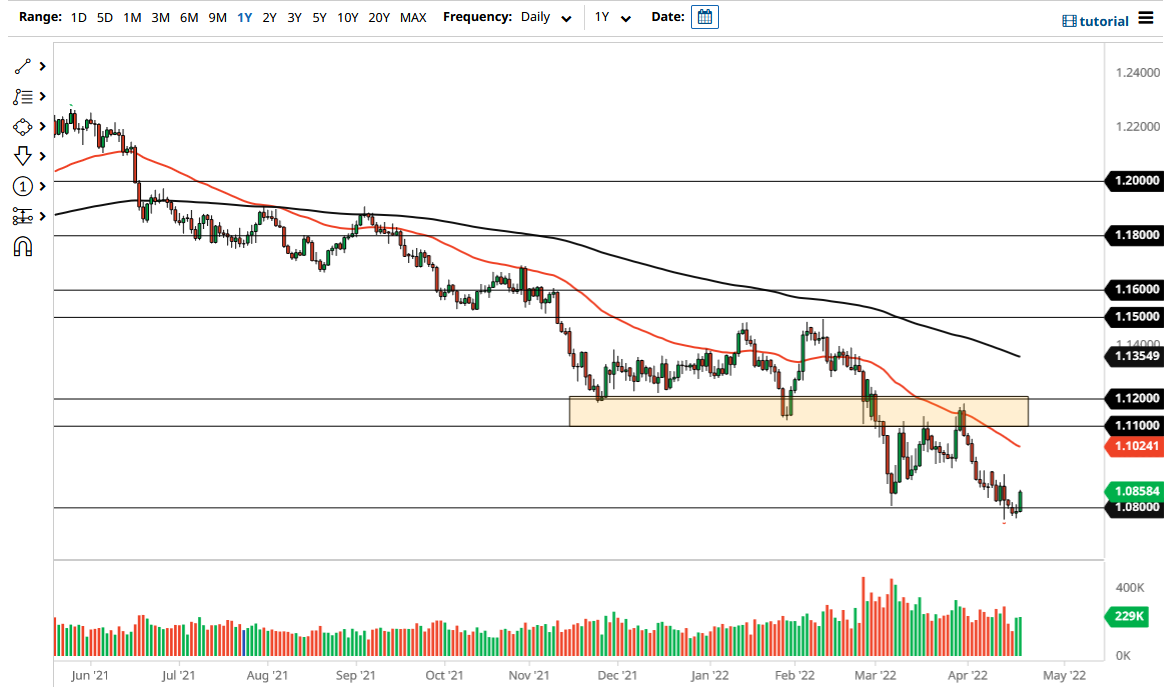

The Euro has rallied a bit against the US dollar during the trading session on Wednesday, as the 1.08 level continues to put up a significant amount of fine. That being said, we are still very much in a downtrend, and it is difficult to get overly excited about owning the Euro right now. After all, the central banks in Europe and the United States could not be any further apart if they tried.

In the United States, the Federal Reserve is aggressive in its hawkishness, and almost certainly will be raising interest rates multiple times this year. In the EU, the European Central Bank is essentially stuck in a pattern of having to be relatively loose with monetary policy, simply because the inflation is relatively strong, but at the same time, there is a lot of uncertainty in the European Union, as we have the war in Ukraine and a serious slowdown on the horizon. Furthermore, the bond yield differential continues to favor the US, as real rates have now entered positive territory.

If we do rally a bit, the 1.0933 level will more likely than not offer a bit of resistance, as we have seen selling pressure there multiple days in a row. Breaking above that then has the market challenging the 50 Day EMA, which is just above the 1.10 level. It is drifting lower, so that does suggest that we will continue to have downward momentum to get involved in this market. I have no interest in trying to get long of the Euro anytime soon, but if we broke above the 1.12 handle, then I would have to start to rethink the entire situation. We are a bit oversold at the moment, so a little bit of a bounce makes a certain amount of sense, but that will more likely than not just be an opportunity to pick up “cheap dollars.”

The only thing I think you can count on in any market at this point is going to be a lot of volatility, so keep your position size reasonable. The timing might be difficult as we will get the occasional headline that causes a bit of chaos, and therefore has an effect on this market. I prefer to wait for signs of exhaustion above in order to get involved, as the trend has been so relentless.