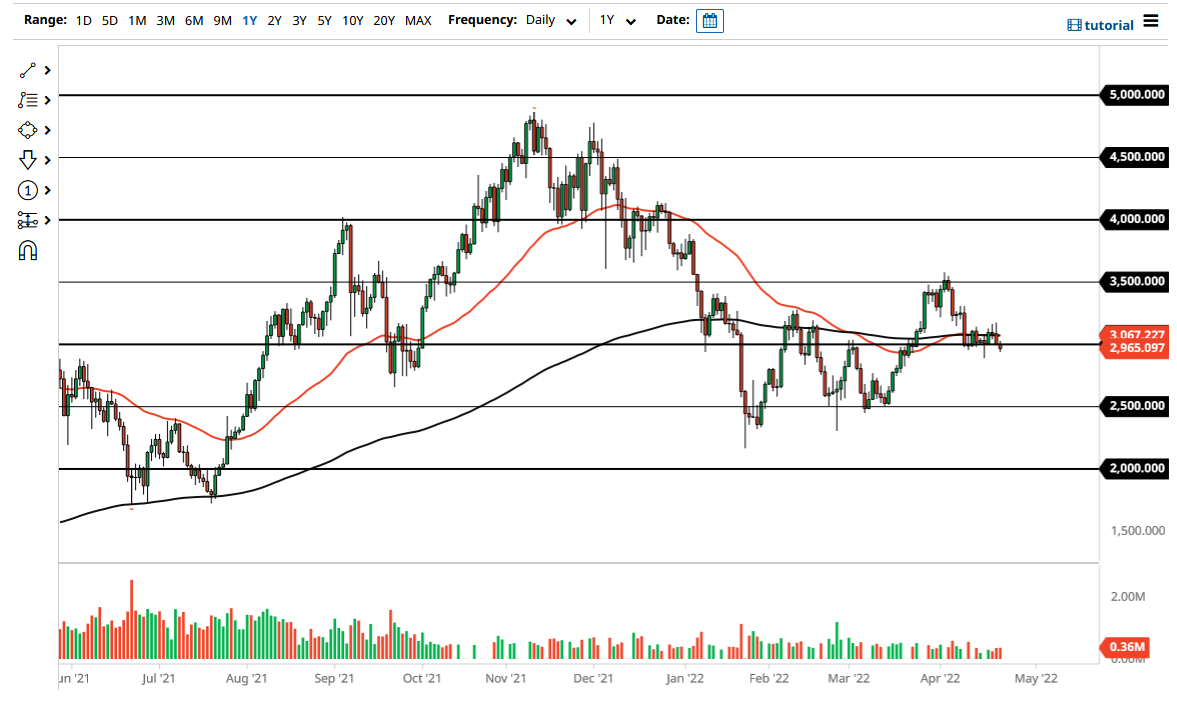

The Ethereum market broke below the $3000 level on Friday and now looks as if it is going to threaten the Monday candlestick. The Monday candlestick was a major hammer, and if we break down below the bottom of that candlestick, then Ethereum is likely to go much lower. At that point, I would anticipate that Ethereum falls to the $2750 level below.

If we break it down below there, then it is likely that Ethereum will go looking to reach the $2500 level. The $2500 level has been important multiple times, so I think it does make quite a bit of sense that we would see support come into the picture there. There is also the possibility that we will break down below it, and the market could drop down to the $2000 level. If we break down below the $2500 level, it would probably make a good signal that it is possible that we could see crypto assets in general fall.

On the other hand, if we turn around a break above the $3100 level, then it is possible that we could go looking to the $3500 level. The $3500 level above is where we had pulled back from previously, so it does make sense that we would see massive resistance. If we were to somehow break above the $3500 level, it would be extraordinarily bullish for Ethereum and could open up the possibility of rising to the $4000 level.

At this point, it is obvious to me that the market is going to remain very choppy, and of course, confused. Because of this, this is a market that I think will continue to be very noisy, but it certainly looks as if we are threatening the downside at the moment. It is also worth noting that Bitcoin had fallen during the day as well, and looks as if it is threatening its Monday low. Watch both of these charts, because one typically will lead the other. The 50-day EMA and the 200-day EMA both sit in the same region and go sideways which typically means that we have no real directionality at the moment, so I would not get overly exposed to Ethereum with a big position.