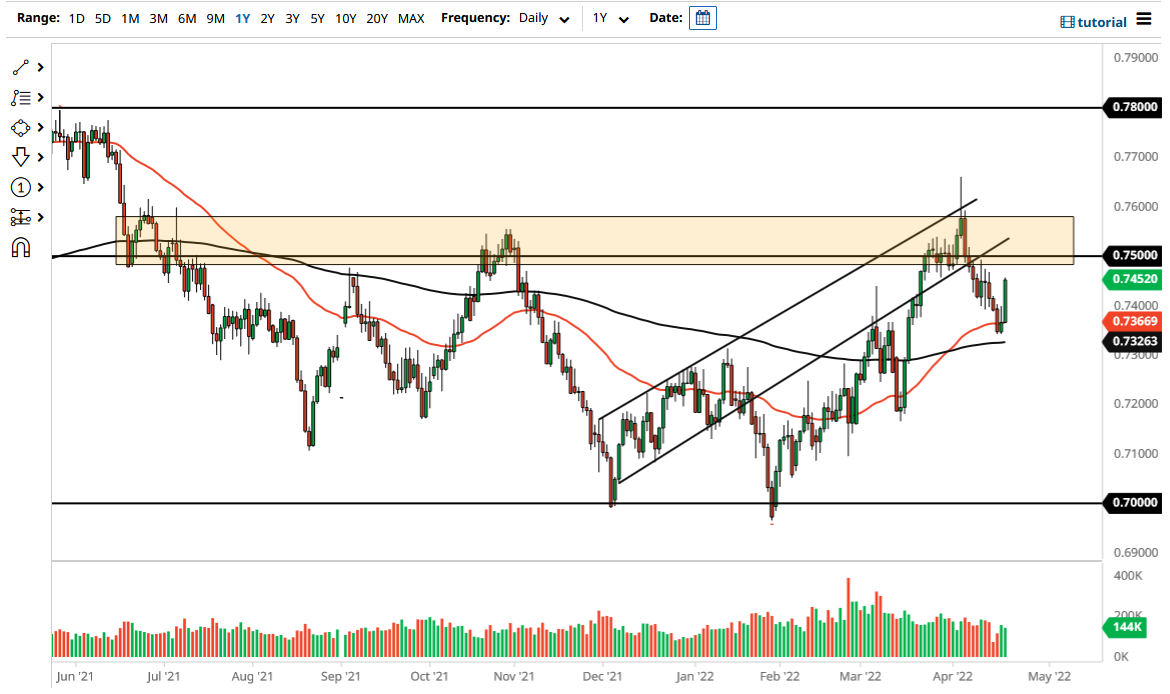

The Australian dollar shot straight up in the air during the trading session on Wednesday to break above the 0.74 level. By doing so, the market looks as if it is going to threaten the 0.75 level just above, but quite frankly I think it is only a matter of time before we see a significant amount of selling pressure. The 0.75 level is a large, round, psychologically significant figure that a lot of people will pay close attention to, as it is so important multiple times in the past.

The size of the candlestick is rather impressive, so that does suggest that there could be a little bit of follow-through. Nonetheless, it is probably only a matter of time before we see sellers jumping into this market, so I do think that if you wait for signs of exhaustion, you might have a nice shorting opportunity. However, you need to pay close attention to commodities, because they have a major influence on what happens with the Australian dollar, so it is worth noting that the commodities markets are very volatile at the moment.

If we turn around and break down below the lows of the candlesticks this week, then it is possible that we will challenge the 200 Day EMA. The 200 Day EMA sits just above the 0.73 level, and therefore I think there is a big support region that could come into play on any type of breakdown. If we were to break down through that level, that is very likely that we could see further negativity.

It is worth noting that the last time we broke above the 0.75 level the Reserve Bank of Australia dropped the word “patience” from the statement, but we since have had the FOMC Meeting Minutes come out more hawkish than anticipated. In other words, think there is a lot of volatility and noise just above and it is going to be difficult to break out. However, if we do slice through all of that noise and get above the 0.76 handle, that is likely that the market goes looks to reach the 0.78 level after that. Regardless of what happens next, I believe that there should be plenty of noise just above, and the next couple of days could be rather choppy and noisy.