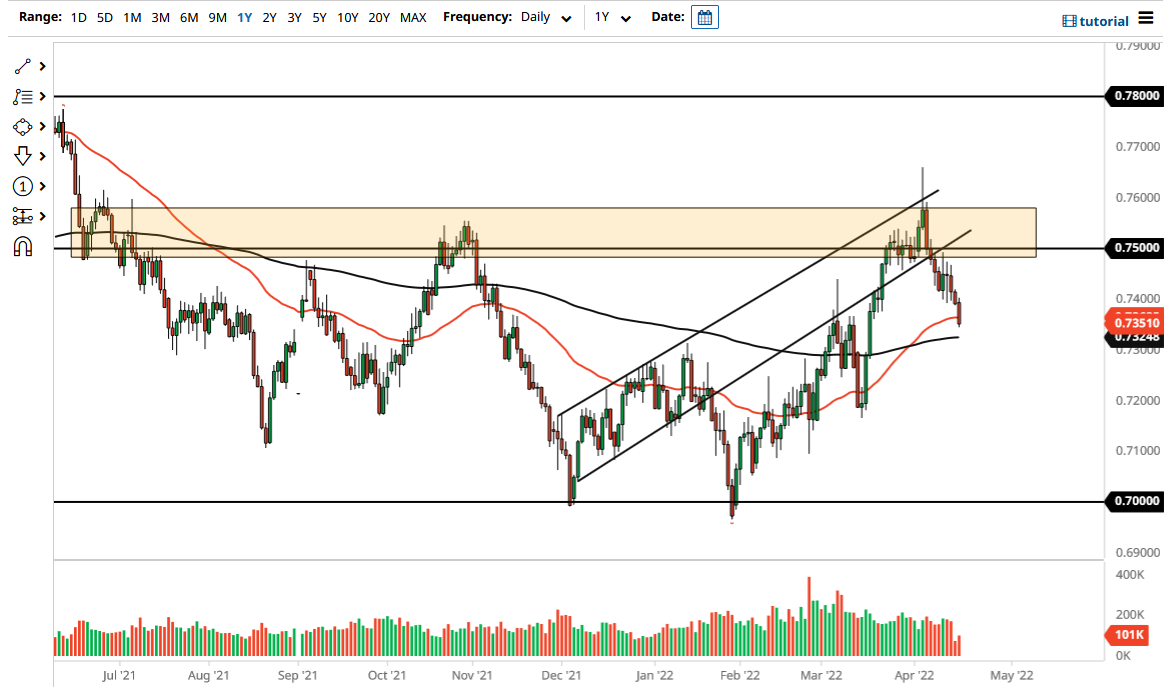

The Australian dollar has fallen a bit during the trading session on Monday to break down below the 50 Day EMA. The market is closing towards the bottom of the candlestick, and that of course is something worth paying close attention to. The Aussie dollar has been falling for a while now, so it does suggest that we are simply going to continue going lower. By breaking below the 50 Day EMA, we may go looking to reach the 200 Day EMA below at the 0.7325 area.

Looking at this chart, it is obvious that the market is now going to be dealing with a squeeze between the 50 Day EMA and the 200 Day EMA. Because of this, I think you need to be very cautious about whether or not this market is going to suddenly kick off a lot of inertia because that does tend to happen when the market trade between these two moving averages. Whether or not that is the case this time remains to be seen of course, but it certainly looks as if the Australian dollar is going to continue to struggle.

Pay close attention to the US dollar in general, because if it does continue to strengthen in other markets, then one would anticipate that it would do the same against the Australian dollar. Ultimately, the US dollar starts to lose strength against most assets, it will more likely than not do the same in this market. Because of this, I do not necessarily think that the market is worth getting overly excited about, but it looks to me like we are set up for more of a pullback than we have seen so far. However, if we were to take out the 0.74 level to the upside, that could change enough to send the market looking to reach the 0.75 handle. There is a significant amount of resistance that extends to the 0.76 handle, so I would anticipate exhaustion in that area where we pull back yet again.

As long as risk appetite is all over the place, the Australian dollar will be the same. Quite frankly, we just do not have enough clarity with anything right now to think that the Aussie is suddenly going to be a big move and less of course at some type of shock to the system.