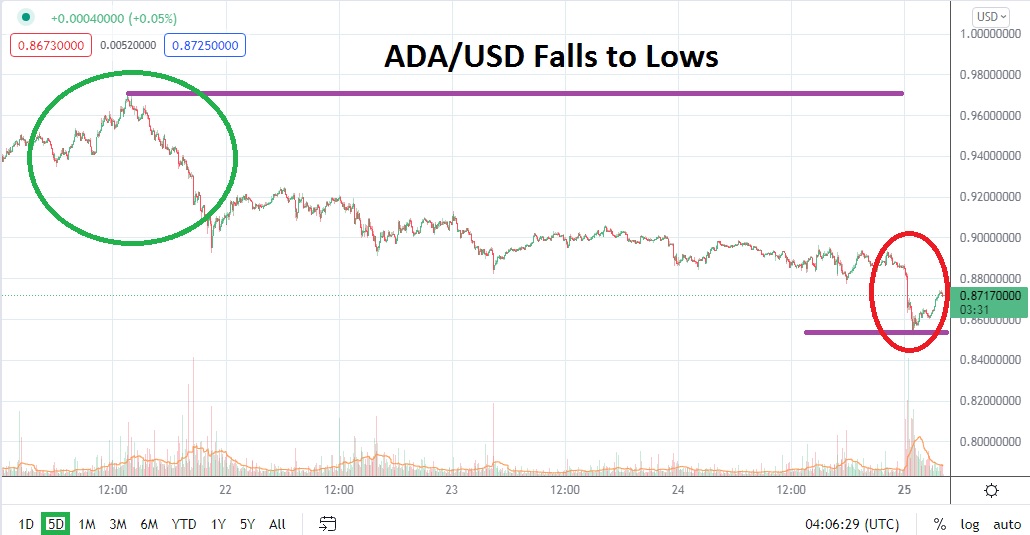

In fast and volatile early trading this morning, ADA/USD is above the 87 cents mark. However, only a little while ago, Cardano tested lows near the 0.85420000 vicinity which is a value that had not been touched since the 19th of March. ADA/USD has mirrored the results from the broad cryptocurrency market and strong selling certainly was a factor this past weekend, without the aid of any strong reversals taking place. This morning’s brief upside move may prove to be momentary.

Technical traders will have to long at mid-term charts to consider where possible support levels may prove to be strong. Unfortunately, this newest cycle of selling which has developed since the last days of March has proven resilient. ADA/USD traders now have to consider the prospect that the rise in prices generated from the 14th of March until the 28th of that month was in fact a false rally, and that the long term bearish trend is still in control.

Having touched new short term lows this morning below 86 cents, ADA/USD traders should watch the current price of Cardano carefully. Quick and volatile trading conditions are likely to continue near term. If ADA/USD cannot sustain its 0.87050000 mark and falls below this and starts to test short term support levels again near the 0.86750000 to 0.8643000 levels, this would certainly not be a good sign for bullish activity.

Yes, bullish speculators looking for sudden reversals higher can wager on upside. However in order to take advantage of upturns, entry price orders will be needed to protect fills and take profit targets will have to be kept realistic. The trend in ADA/USD has been downward, and until a strong amount of buying is demonstrated in Cardano and the broad digital asset market gathers some equilibrium, new lows may be exhibited.

If support falters and the 85 cents level again comes into view, traders should consider the prospect that a move towards lows seen in the second week of March may come into play for ADA/USD. Sellers also should remain cautious and not overextend a trade to seek additional riches when solid profits have already be attained.

Short sellers should certainly follow momentum. If the trend remains bearish pursuing lower price depth may prove to be logical, but traders should also cash in winning trades before slight reversals. Take profit orders and careful choices of leverage should be used by all speculators.

Cardano Short-Term Outlook

Current Resistance: 0.87660000

Current Support: 0.86530000

High Target: 0.90780000

Low Target: 0.82910000