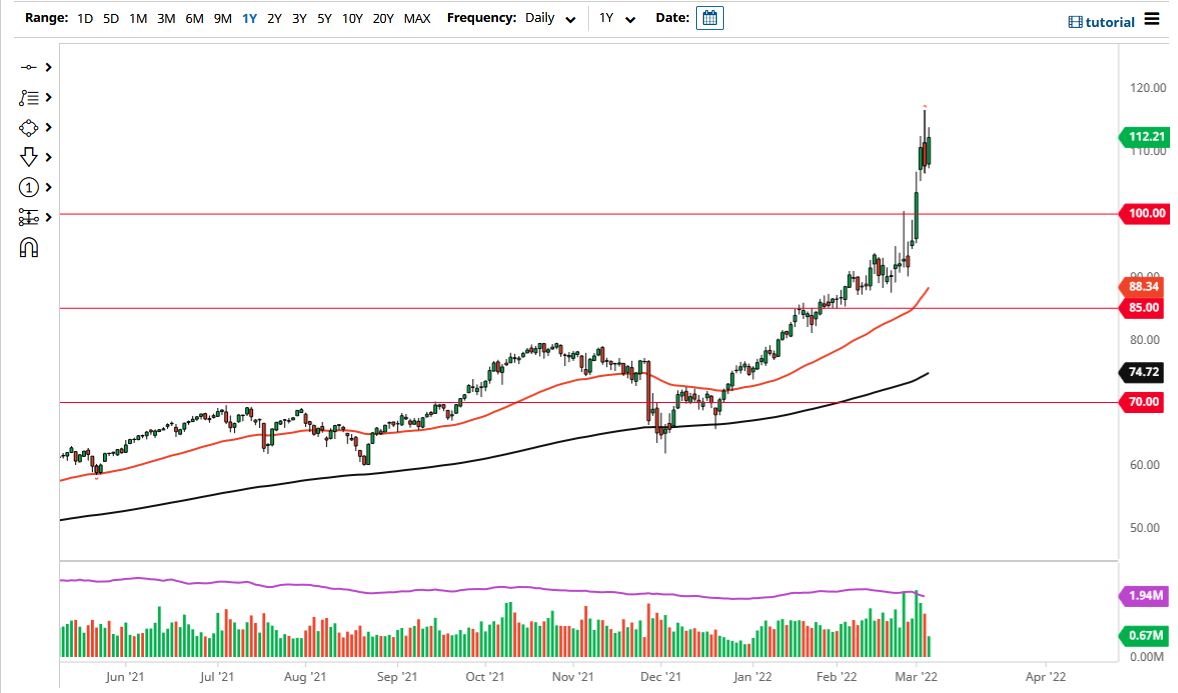

The West Texas Intermediate Crude Oil market rallied significantly on Friday to break above the $112 level. That being said, the market pulled back just a little bit towards the end of the day, because I think a lot of profit-taking is going to happen. After all, there are a lot of potential problems out there. We are so overbought that it would not surprise me at all to see something like that.

Do not get me wrong, this is not a market that I would be selling anytime soon, just that I recognize that it has gotten a bit overheated. A pullback would be healthy, and I do think that given enough time we will probably try to fill the gap underneath. That could have the market going to the $105 level, which is a very reasonable short-term pullback. For that matter, I believe that we could pull back to the $100 level as well, as it was the scene of the most recent massive push higher. There is a certain amount of “market memory” just waiting to happen there, so I do believe there will be a lot of interest.

On the upside, believe that the market will eventually go looking towards the $120 level, and that could happen much quicker than anticipated. After all, we have seen a lot of people worried about the Russian supply, because even though there are no real flat-out restrictions on Russian crude, on the whole, the reality is most shipping companies have no appetite to take the risk of moving the product. This essentially takes 10% of the world’s crude oil out of the market. This is all while we are going through the reopening trade, and we saw very little in the way of production during the previous year.

If we do see the market move above the highs right away, then we will become parabolic, which is a very difficult and dangerous market to be involved in. Regardless of what happens next, I do believe that you probably need to wait for some type of pullback in order to find value in this market.