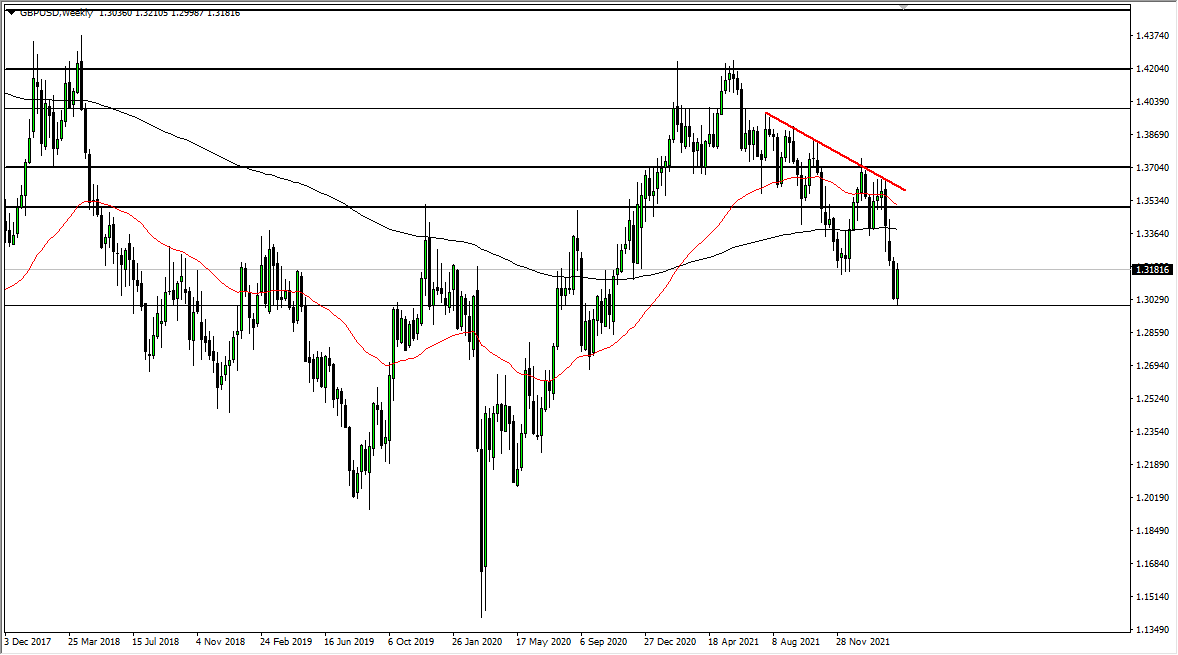

EUR/USD

The euro rallied most of the week, gave back some of the gains, and now looks as if it is trying to break higher yet again. The 1.12 level above is the absolute “ceiling in the market” that I see, so more than likely we will see sellers coming in on the attempted breakout. However, if we do get a daily close above the 1.12 level, then it is possible that we are going to turn everything right back around. On the downside, I see the 1.08 level as a major support level. Ultimately, this is a market that is going to be choppy, but even though we have seen quite a bit in the way of bullish pressure, we still have not broken the downtrend.

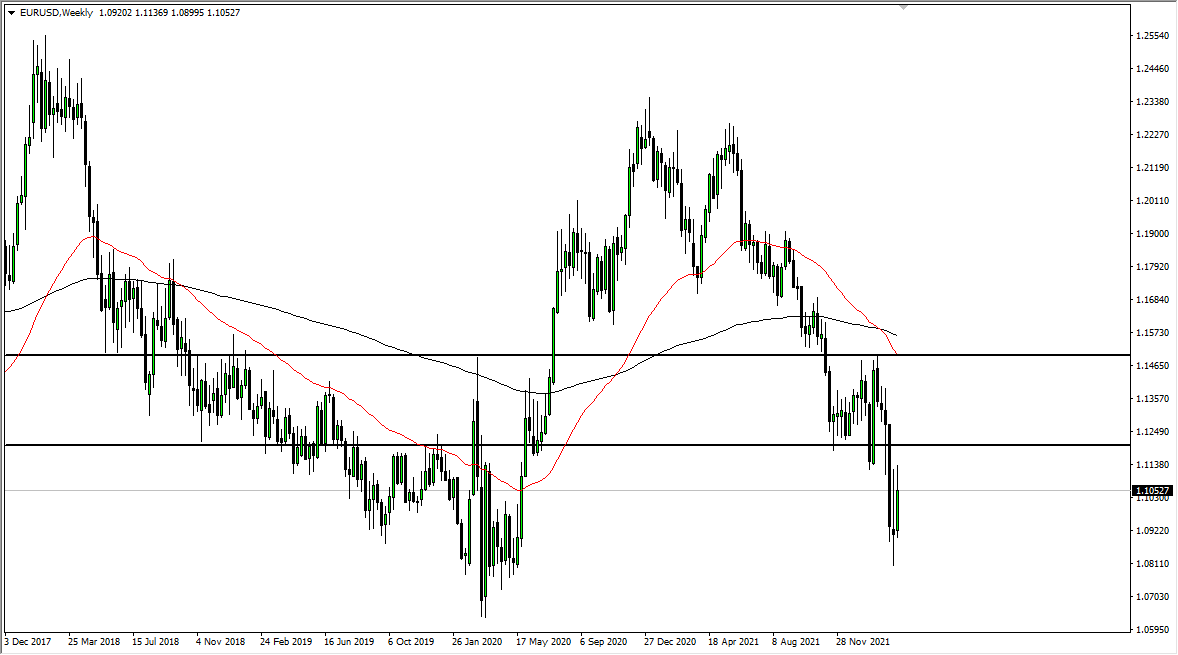

GBP/JPY

The British pound has rallied rather significantly last week and closed at the very top of the range. This suggests that we are going to continue to see upward momentum, and if we can break above the ¥158.50 level, it is possible that we could go looking towards the ¥160 level. That being said, this is also an area where you would expect the sellers to step back, but this is a very stout candlestick. Unfortunately, we have seen this happen before where the market shot straight up to this area and then pulled back. I am speaking specifically of the October 10 candlestick from last year.

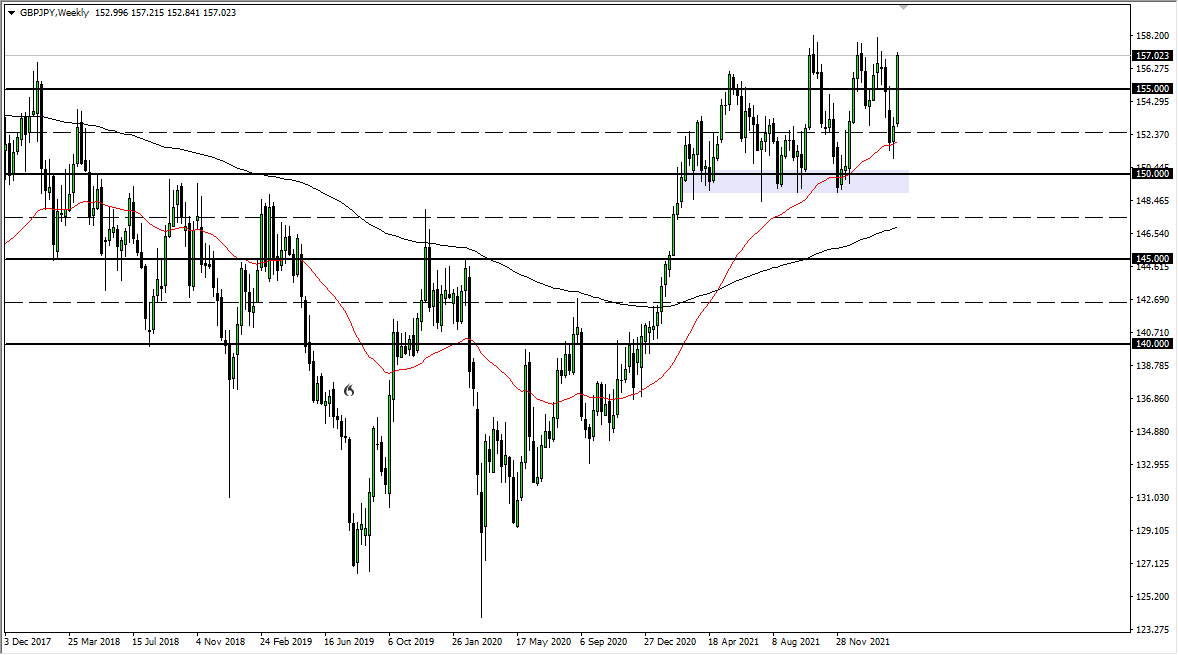

USD/JPY

The US dollar shot straight up in the air against the Japanese yen yet again last week, and the situation here looks as if it has gotten a bit overdone. Pullbacks will be looked at as buying opportunities, but I cannot buy this pair up here. If we were to continue seeing upward pressure on this pair, I might do something like buy the AUD/JPY pair, or even the NZD/JPY pair, as they are getting ready to break out to the upside.

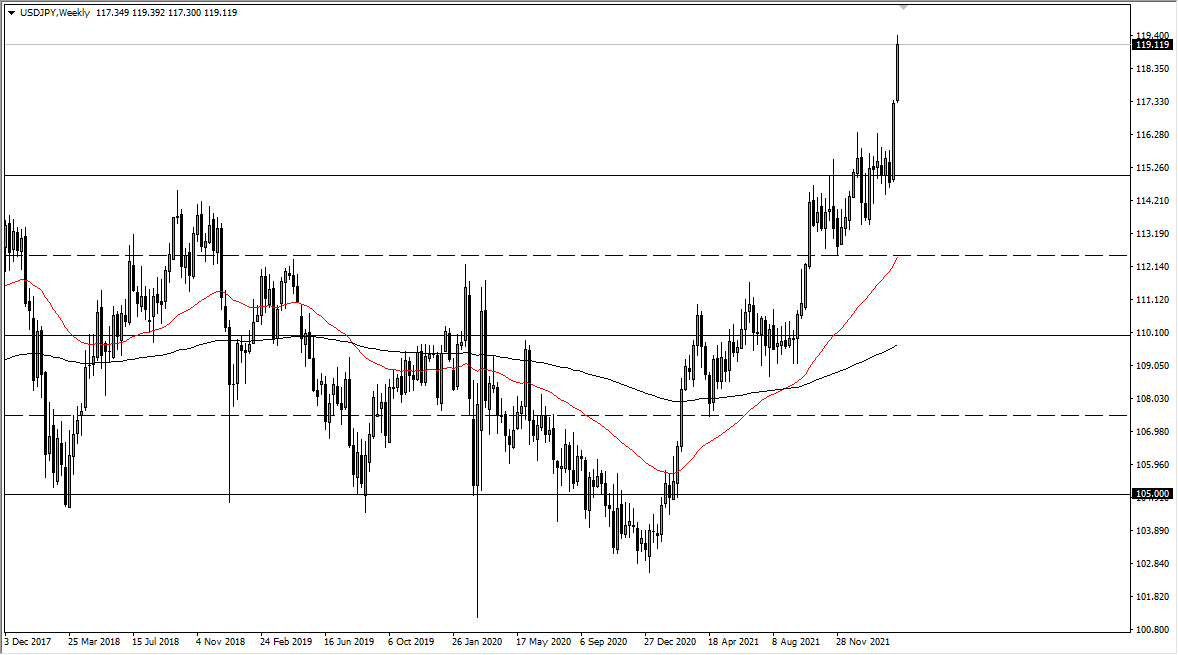

GBP/USD

The British pound shot straight up in the air last week against multiple currencies, and as you can see here against the US dollar, it was bullish. However, the market has shown itself to be a little less impulsive against the greenback than it was against multiple other currencies. The 1.30 level underneath should offer a nice floor in the market, but if we were to break down below there, it could open up a move down to 1.28. Breaking above the 1.32 level opens up the possibility of a move to the 1.34 handle.