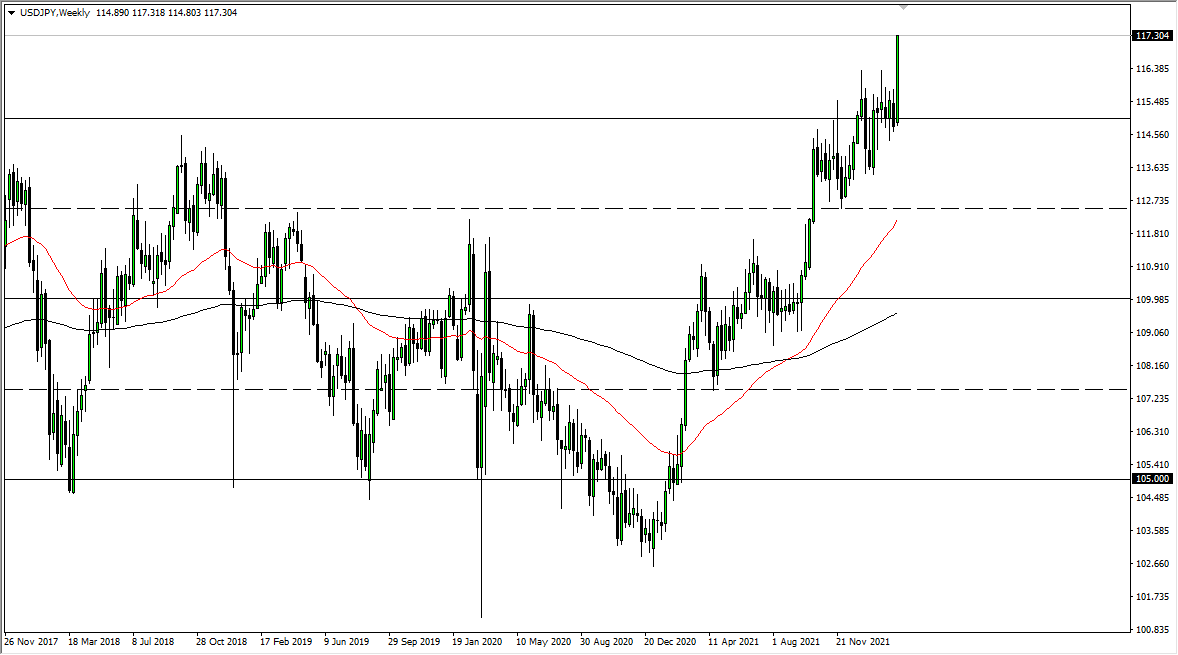

EUR/USD

The euro is all over the place during the course of the week, as we continue to see a lot of volatility. This is a market that looks as if it is ready to go lower because it cannot hang on to gains. However, that does not necessarily mean that we are going to break down drastically. I think this is more or less going to be a market in which you fade short-term rallies, but take profits somewhat quickly. We have the Federal Reserve meeting during the week so that has a huge influence on what happens next.

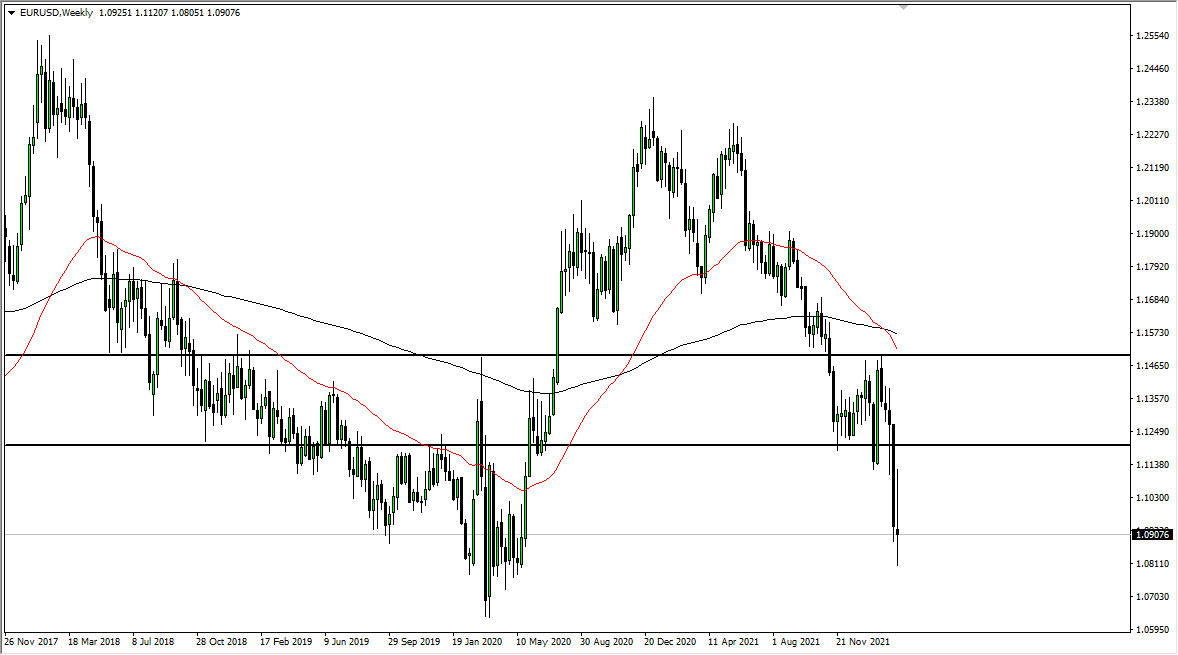

GBP/JPY

The British pound initially fell against the Japanese yen during the course of the trading week. However, we rallied quite a bit to reach above the ¥152.50 level, and a closed near the ¥153 level. This is a market that will probably go looking towards ¥155 level, as long as we have more of a “risk-on” attitude out there. If we do not, then it is possible that we could turn around and break down towards the ¥150 level, an area that I see a lot of support in. Either way, I think volatility is the only thing that you can probably count on.

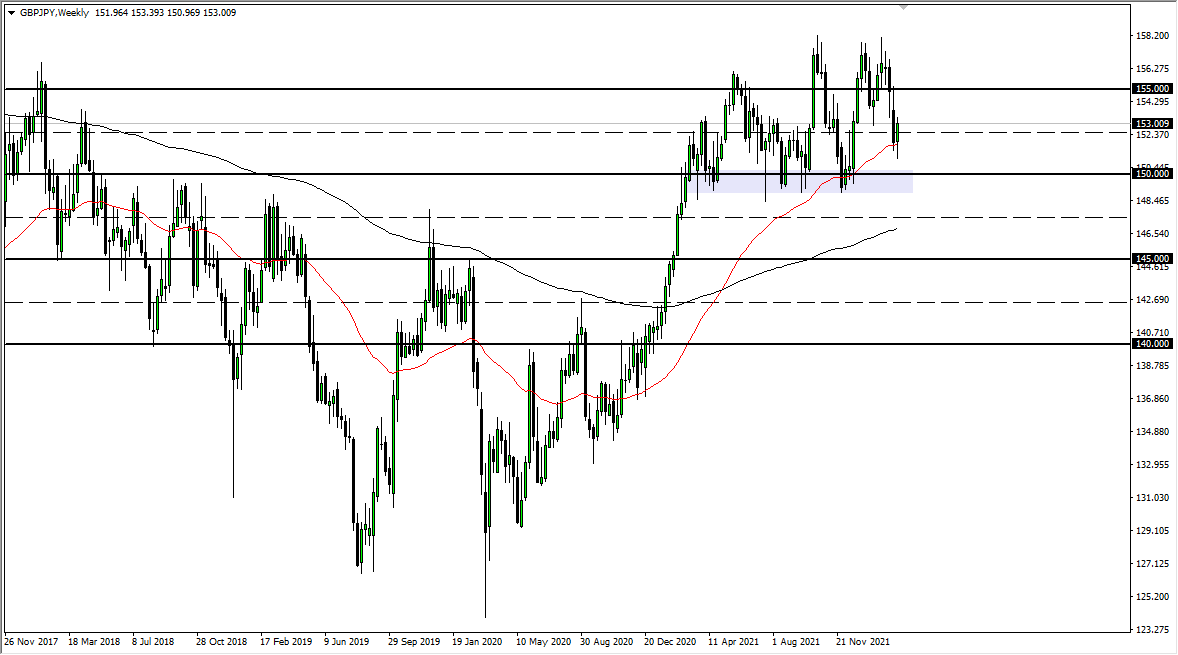

USD/CAD

The US dollar initially tried to rally against the Canadian dollar, showing signs of strength. However, we have given up quite a bit of the gains to form a shooting star. This was preceded by a hammer, which suggests that we are going to go back and forth and perhaps try to figure out where we will go long term. You can see that this is a chart that has been very noisy, and you can also see that we have formed an ascending triangle for this market. If we can break above the high of the weekly candlestick, then I think this market will take off to the upside. On the other hand, if we break down below the bottom of the hammer from the previous week, then it is likely we will go looking towards the 1.24 level.

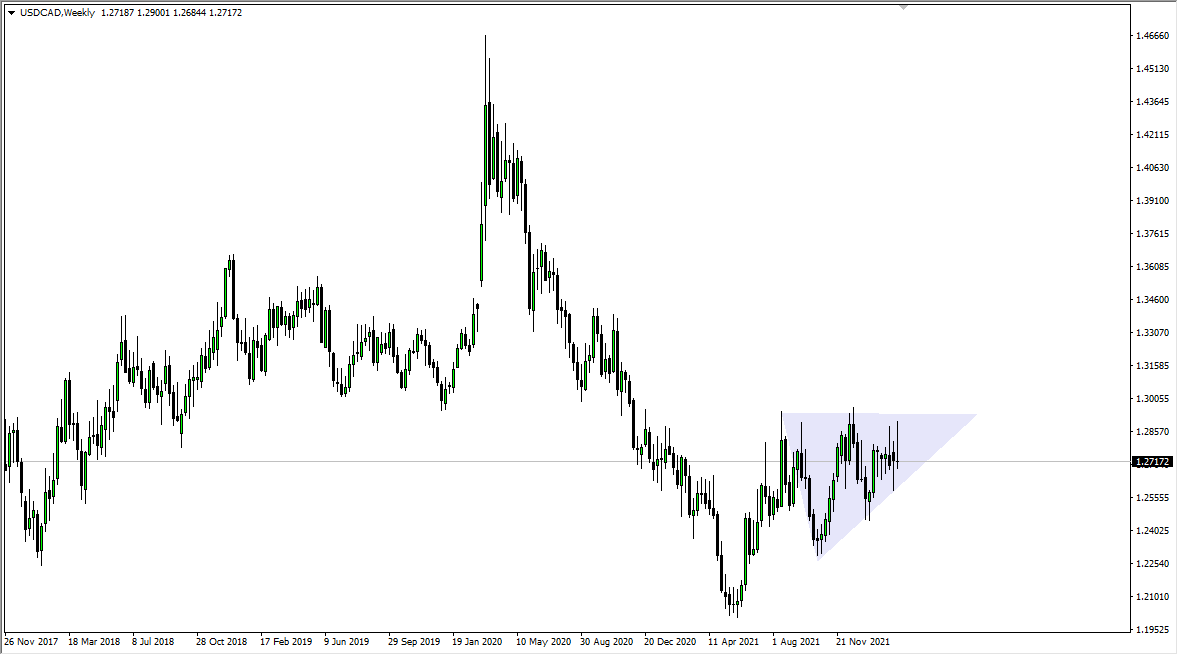

USD/JPY

The US dollar rallied rather significantly during the course of the week, breaking above the ¥116.33 level, an area that had been massive resistance previously. This breakout is a major turn of events, and it does in fact suggest that the US dollar is going to continue to climb against the yen. Ultimately, I think that short-term pullbacks will continue to offer buying opportunities.