Today's recommendation on the lira against the dollar

- Risk 0.50%.

- The sale deal on Thursday was activated and a profit was exited after closing half of the contracts and moving the stop loss point

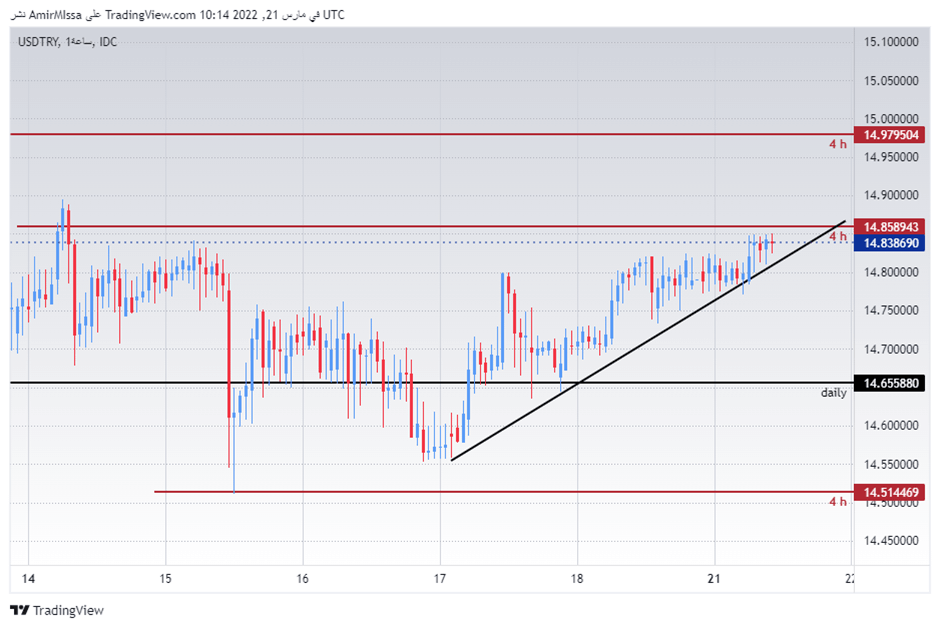

Best entry points buy

- Entering a long position with a pending order from 14.55 levels

- Place your stop-loss point below the 14.36 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 15.00.

Best selling entry points

- Entering a short position with a pending order from 14.87 levels.

- The best points to place the stop loss are the highest levels of 14.98.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira fell against the dollar during trading at the beginning of the week, as pressure continued on emerging market currencies with the dollar's rise after the decision to raise US interest rates during trading last week. In the same week, the Central Bank of Turkey decided to fix the interest rate for the third month in a row, against the will of the bank's monetary policy management, which is under the control of Turkish President Recep Tayyip Erdogan. To face the lira’s decline and high inflation in the country, observers expect the lira’s declines to continue in general, in light of the US Federal Reserve’s tendency to raise the interest rate several times during the current year, which means the dollar continues to rise and pressures on the Turkish lira continue.

The Turkish lira fell against the dollar to maintain the general bullish trend, as the pair is still trading above the 50, 100 and 200 moving averages, respectively. This is on the daily time frame, the four-hour time frame, as well as the 60-minute time frame. Currently the pair is trading above the rising trend line on the 60-minute time frame shown on the chart. The pair is trading the highest levels of support, which are concentrated at 14.65 and 14.51 levels, respectively. On the other hand, the lira is trading below the resistance levels of 14.85 and 15.97, respectively. The pair may target 15.26 levels, which represents 61 Fibonacci for the last bearish wave, which started at 20-12-2021 and ended on 23-12-2021, if the top of the ascending trend line continues. Please adhere to the numbers in the recommendation with the need to maintain capital management.