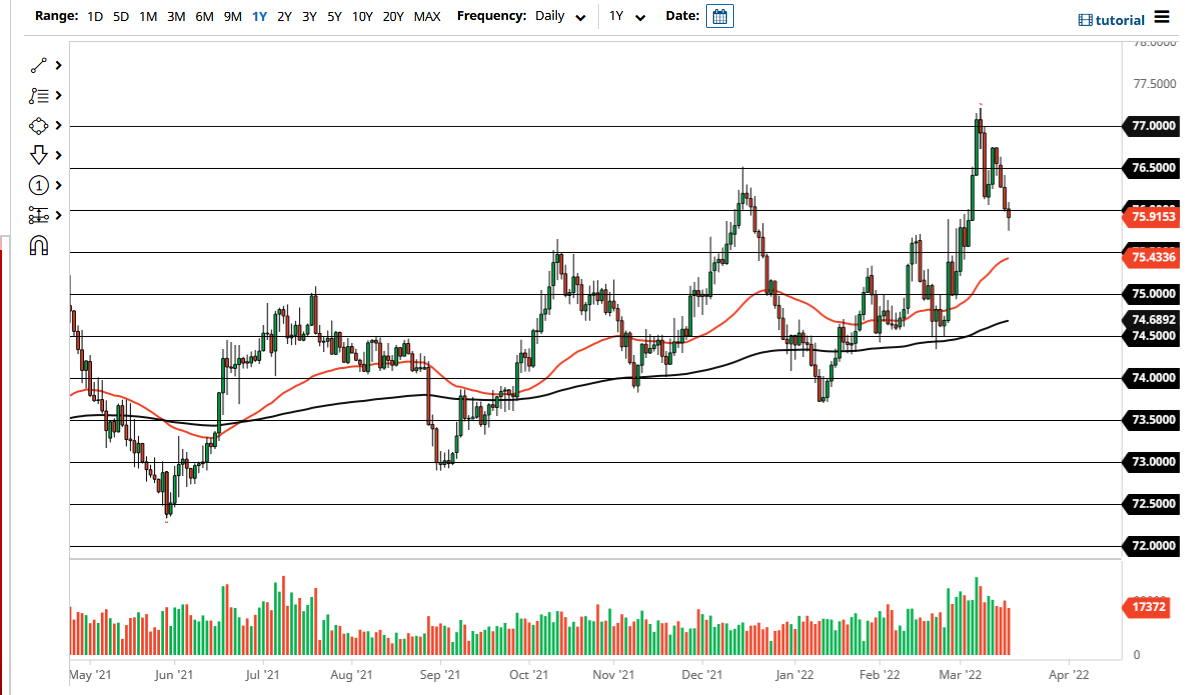

The US dollar has fallen a bit against the Indian rupee during trading on Thursday but has found a bit of buying just below the ₹76 level. By doing so, the market ended up forming a bit of a hammer which looks quite a bit like a perfect “pull back and retest” of the overall trend. Because of this, if we can break above the top of the candlestick for the Thursday session, it is very likely that the pair will go looking towards the ₹76.50 level.

Market participants continue to see the US dollar as a greater value, as we have been in an uptrend. Furthermore, you have to worry about some emerging markets as a global slowdown is certainly going to be felt places. The Indian government is not only is the most business friendly, and therefore the US dollar does tend to “buck the trend” against emerging markets in this currency pair at times.

Underneath current trading, the ₹75.50 level might be an area of interest, as it has not only been structurally important previously, but it also has the 50 Day EMA moving into the same area. Because of this, I would anticipate that a certain amount of technical buying may occur if we get to that area. I do believe that it is probably only a matter of time before we continue the uptrend, but if we were to break down below the ₹75 level, then we might have bigger issues at hand.

It is difficult to imagine a scenario where the US dollar sells off for an extended amount of time, simply because the world’s economy seems to be slowing down and of course we have issues when it comes to a whole host of things, not the least of which would be a war in Ukraine. The US dollar is a safety currency, and while the cross between the greenback and the rupee is not necessarily one of the heavily traded currency pairs, US dollar strength or weakness across-the-board typically will have at least some effect on what happens here. Because of this, I think that we are setting up for a continuation of the rally and perhaps a move to the ₹77 level over the longer term. It might take a while to get there, but it certainly looks as if that is what we are setting up to do.