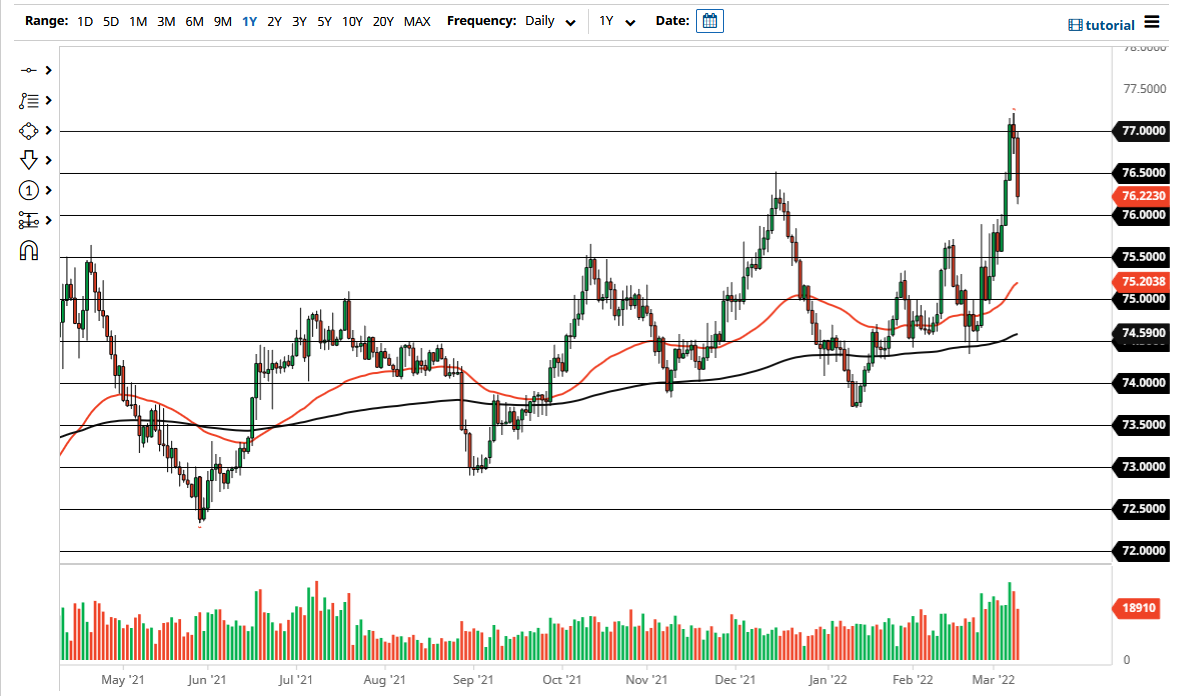

The US dollar broke down significantly on Thursday to go falling well below the ₹77 level again. The ₹76.21 level is currently being tested, and most clearly the ₹76 level underneath will more than likely be supported.

The pair had recently broken out above the top of a major resistance barrier, so this massive selloff could simply be an opportunity to retest that level for support so that we can turn around and go higher. If that is the case, then the next day or two should end up being rather supportive and should eventually be jumped upon by the longer-term traders. As long as we can stay above the ₹75.50 level, it is likely that we will see buyers coming in to pick this market back up.

However, if we did break down below the ₹75.50 level, then it is possible that we could see more of a significant selloff. This would more than likely be a scenario where we would see the US dollar falling against almost everything, not just the Indian rupee. The 50-day EMA is starting to reach towards the ₹75.50 level as well, so I think it makes a bit of natural sense that the level could be of importance.

If we turn around right here, then we will test the ₹77 level. If we can break above there, then it is likely that we would go much higher, with the initial target being the ₹77.50 level. Market participants continue to see plenty of demand for US dollars, so I do think that it is probably only a matter of time before we see this market find buying pressure. After all, we are starting to think about the overall economic health of the world, and if there is going to be a slowdown it typically will favor the US dollar overall. Certainly, people will not be throwing a ton of money at emerging markets, including India.

The size of the candlestick is worth noting, as it is rather impressive, but this is a market that I think is going to continue to be noisy, so it is likely that there will be a little bit of follow-through in the short term. Keep in mind that if we go more “risk off”, that should send this pair higher.