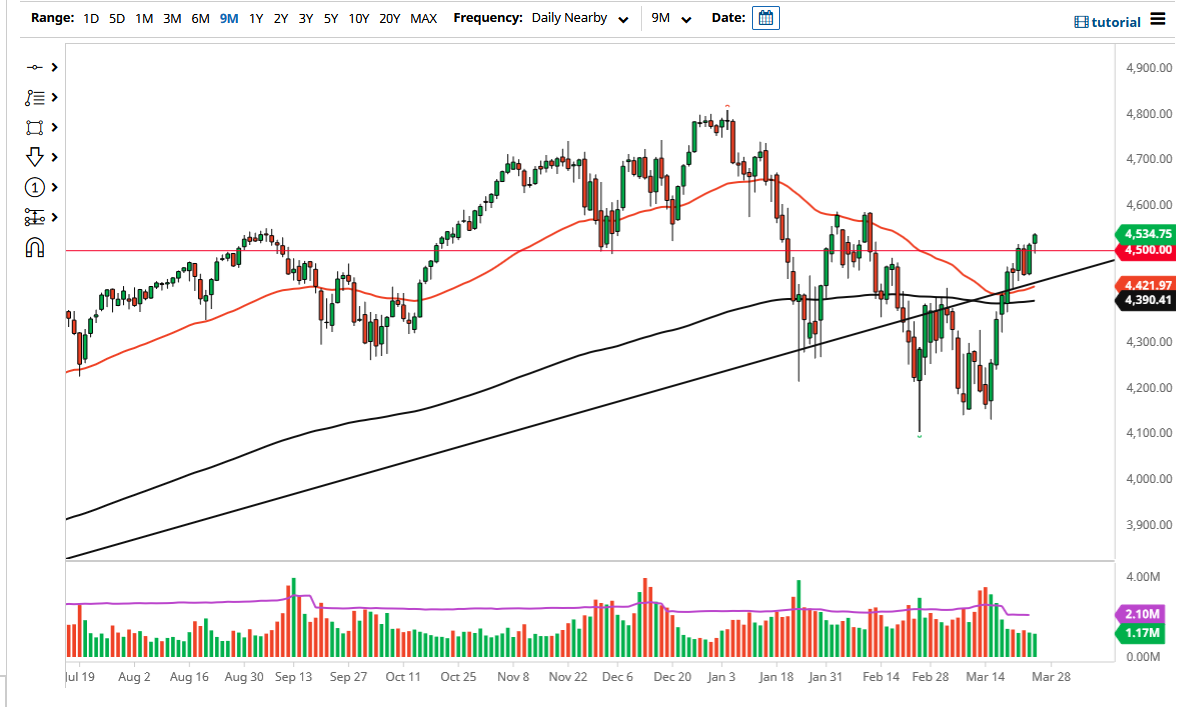

The S&P 500 initially fell on Friday and looked as if it was going to struggle for a bit, only to save itself at the end of the session. This is quite typical as institutions come in late in the day and pick up stocks. That being said, the market is more likely than not going to face a bit of resistance between here and the small double top that sits at the 4585 handle. The area should be difficult, but it is going to be interesting to see whether or not we can break above there. If we do, then all of the negativity is suddenly gone.

What is interesting is that bond yields continue to race higher, as the bond market does not seem to be as excited about the prospect of the Federal Reserve backing down like Wall Street is. Most Wall Street pundits think that the Federal Reserve will not dare raise interest rates in this inflationary environment, but Jerome Powell may have no choice. If that is the case, it will absolutely crush the stock market, especially if he has to do it rapidly in an environment that is very dangerous.

On the other hand, if Jerome Powell sides with the institutional bankers again, then it is very likely that inflation will run hot, and stocks will be bought as an inflation hedge. This would not be conducive to an economy that allows for a lot of profits for companies, but it has been a while since the stock market had anything to do with that. It is more about liquidity at this point, and the more liquidity there is, the higher these markets tend to go.

It is all about monetary flow, and it is likely that it comes down to what the Federal Reserve does. The next few months are going to be very difficult and very noisy, and as a result, it looks likely that the markets will need to be treated with extreme caution. The consolidation just underneath should be supportive, but if we were to break down below there, the 4450 handle will be the gateway to lower prices. Ultimately, this is a market that I think will find its way higher in the short term, but it is only going to take just a little bit of negativity to turn things around.