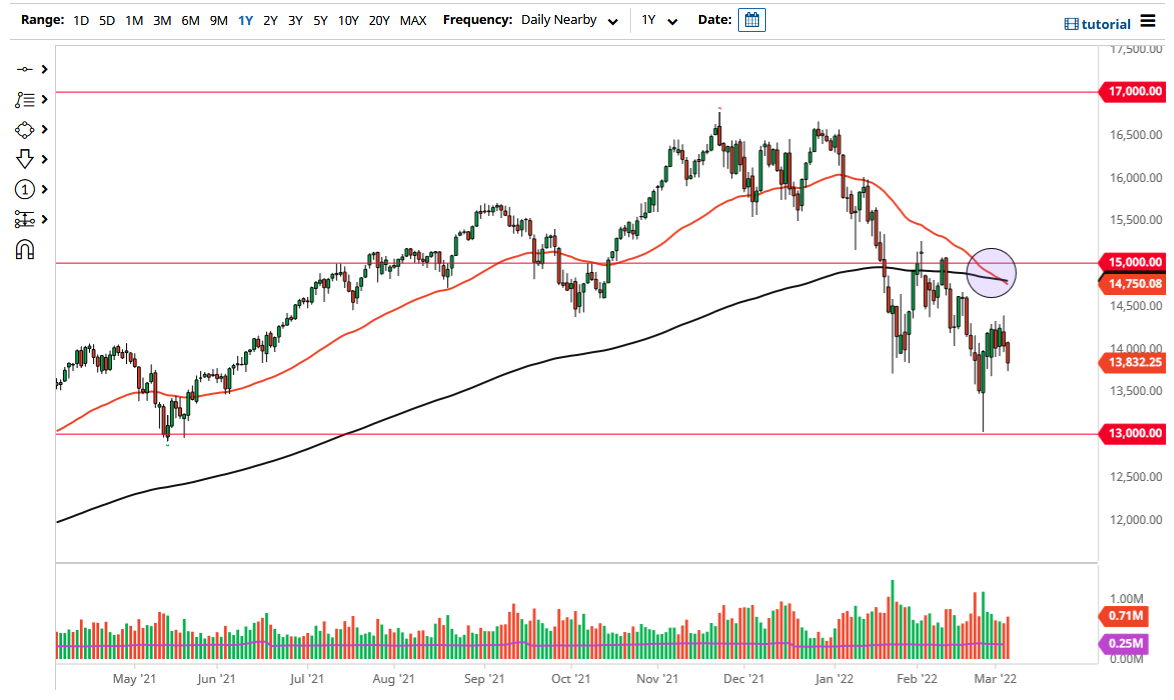

The NASDAQ 100 fell a bit on Friday to slice through the 14,000 level. At this point, the market looks as if it is ready to go looking towards the 13,750 level. That is an area where we see a little bit of support, but we have pierced through there previously, so it does make sense that we could break down below there to reach towards the 13,000 level. That is an area where we had bounced from previously, so it obviously has a certain amount of support built into it.

The NASDAQ 100 needs to find some type of reason to rally, and there is almost nothing out there to lift the market. We could get a cease-fire between Russia and Ukraine, which may get the markets a little bit more “risk-on”, but I just do not see that happening as it looks like the conflict is intensifying, not settling down.

The jobs number in the United States does suggest that the Federal Reserve will have to become much more aggressive with the tightening of monetary policy, as inflation continues to roar. In that environment, the economy typically will slow down, at least that is the hope of the central bank. In a slow-growing economy, the bigger companies in the NASDAQ 100 continue to get hammered as they are high-growth companies.

The NASDAQ 100 is much more volatile than the S&P 500 under most circumstances, so I think this is a market that will clearly see a lot of downward movement. If we break down below the 13,000 level, then the market could very well go looking towards the 4500 level. The 14,400 level above is a little bit of a barrier, so if we can break above there, it is likely that the market will offer quite a bit of volatility near the 14,500 level as well. Looking at the 50-day EMA crossing below the 200-day EMA suggests the so-called “death cross”, a longer-term bearish signal. That signal tends to come a bit late though, but it is one more thing to throw on the pile of negativity. The size of the candlestick is rather negative, and the fact that we are closing towards the very bottom of it does suggest a little bit of follow-through.