In the last trading sessions last week, the GBP/USD exchange rate fell. The pair's bears reached the 1.3185 support level in the morning of today's trading, the lowest for the currency pair in more than two weeks. The decline of the sterling dollar came in sympathy with the general European currency complex, which was subjected to the collapse of fears of the continuation of the Russian war. The GBP/USD pair could be on its way to crack through the major Fibonacci retracement and test the major weekly moving average around 1.3122 over the coming days. Sterling came under significant pressure against all but the most volatile of its continental and emerging market peers on Friday, as the European currency pool sank further in response to the mounting financial, economic, and humanitarian fallout from Russia's attack on Ukraine.

Sterling’s losses piled up alongside a larger drop in the euro/dollar exchange rate, which on Friday was on track for its biggest one-week drop since the most severe phase of the coronavirus crisis in March 2020.

Meanwhile, natural gas prices hit the stars on Friday in price action that is another headwind to the European and global economic outlook, likely to exacerbate mutually reinforcing pressures in the euro as well as currency complexes in Central and Eastern Europe. Analysts noted that the CZK and the Polish zloty rose against the euro after news of the Czech National Bank and the Polish National Bank intervened, although the zloty gave up gains and was still trading weaker against the euro.

The pressure on the Central and Eastern European currencies has already caused some central banks in the European Neighborhood to sell off foreign exchange reserves in an attempt to stem the devaluation of their currencies, and this has fueled the decline of the EUR/USD.

These pressures and their impact on the EUR/USD rate make up a large part of what drove the GBP/EUR exchange rate to its highest level since right after the Brexit referendum on Friday, which in turn is an important development. The Sterling-Euro rate rose 1.5% for the week ending Friday at its highest point, and given the 46% European single currency + share of the Sterling exchange rate index compiled by the Bank of England (BoE), this exchange rate succeeded in neutralizing Losses against other currencies including the dollar.

The price movement of the pound against the euro leaves the trade-weighted pound sterling index unchanged throughout the week and continues the recent trend which, if it continues, will direct the price of the pound against the dollar in the direction of 1.3122 in any market where the price of the euro against the dollar falls to 1.08.

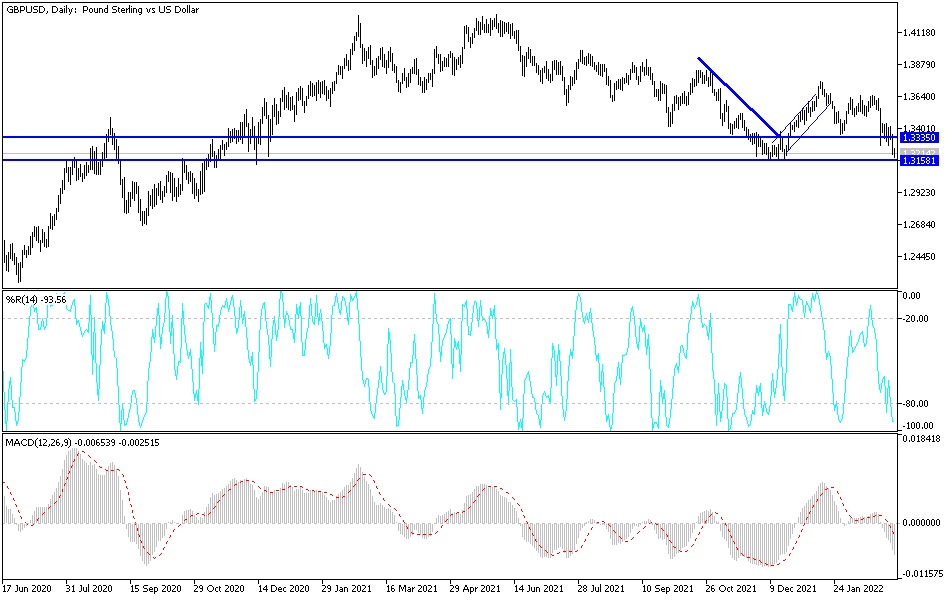

According to the technical analysis of the pair: the bears began to control the price direction of the GBP/USD currency pair. It is preparing to test stronger descending levels in light of the continuation of the Russian war and its closest consequences to the current trend. Support levels 1.3125 and then the strongest psychological support 1.3000. On the upside, and according to the performance on the daily chart, the resistance levels 1.3450 and 1.3560 will be important for the bulls' return to dominate, but the selling operations will remain in light of the negative developments in the European crisis. In general, how high the exchange rate between the pound and the euro will be depends on how bad the situation is with respect to Russia and Ukraine