It seems clear that the price of the EUR/USD currency pair is moving in narrow ranges in the recent trading sessions. The attempts to rebound higher for the pair did not exceed the resistance level of 1.1137. Every time the EUR/USD pair achieves gains that evaporate quickly, the Russian war continues to haunt expectations about the future of recovery. Recently, the bears tried to stop the losses of the Euro-dollar at the level of 1.0960 in order not to experience a stronger bearish momentum, but this would be possible.

The divergence in economic performance and the future of central bank policy remains in favor of a strong US dollar. Yesterday, European Central Bank Governing Council member Ignazio Visco said he does not see unreasonable salary increases in the eurozone - even though consumers are grappling with the fastest rate of inflation since the creation of the single currency.

Visco, who also heads the Italian central bank, added that policy makers are alert to the danger of the so-called second-round effects, in which higher consumer prices lead to demands for higher wages, adding to inflation. But, so far, the upward pressure is silent. "We are not seeing excessive wage increases in Europe," Visco told the Bloomberg Capital Markets Forum in Milan on Wednesday. And “negotiated wages are still on average at 2%, while in the US it is 6%. There may be pressure. We know we have to be very careful with that.”

The war in Ukraine is further fueling the rise in prices, with an emphasis on energy costs due to Russia's position as one of the world's largest exporters of oil and natural gas. But Visco's comments on salaries chime with those of ECB Vice President Luis de Guindos, who recently told Handelsblatt that he does not see inflation feeding on wage demands.

An example is Spain, where some workers are proposing gradual wage increases over the coming years - provided companies restrict dividends and selling prices for their goods. Beyond inflation, concern about economic growth is growing. In some of the first data since the invasion, the European Commission said on Wednesday that consumer confidence in the euro zone fell in March to its lowest level since the early months of the pandemic.

Excluding talk of stagflation, European Central Bank President Christine Lagarde said this week that economic growth would continue even under an "extreme" scenario in which conflict worsens and the response to sanctions is more robust. Visco agreed, saying that if the war did not go on for long, "we may certainly not suffer from stagflation with inflation".

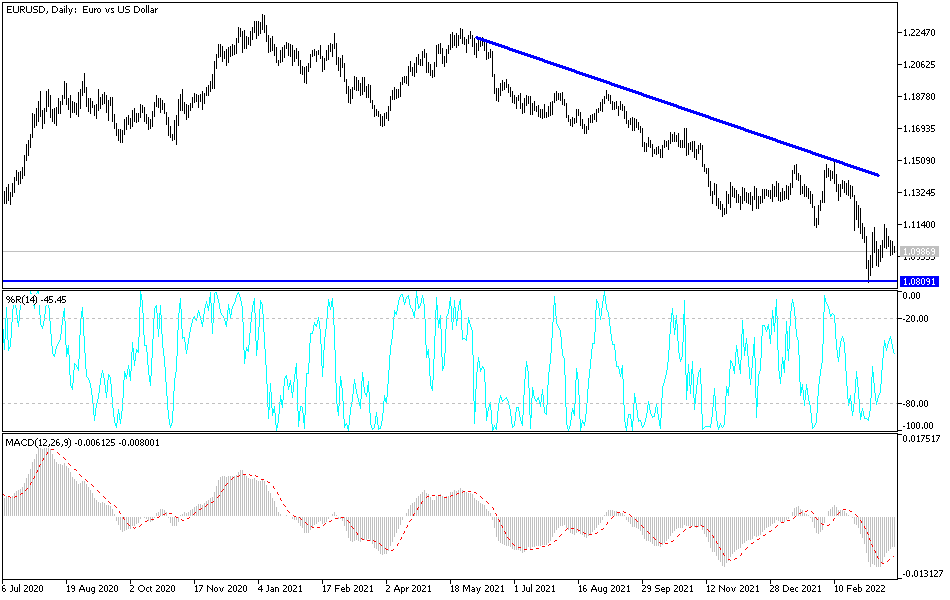

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the euro currency pair against the dollar, EUR/USD. Attempts to rebound upwards are still weak amid the bears’ control over the performance, and as mentioned before, the Russian war will remain a key factor in selling the euro for any gains. According to the performance on the daily chart, breaking the support 1.0920 will support the move towards the psychological support 1.0800, respectively. On the other hand, I see that the bulls' targets may not exceed 1.1160 and 1.1220 over the same time.

The euro may interact today with the developments of the Russian war and the announcement of the reading of the industrial and services purchasing managers index for the economies of the euro area and the monthly report from the European Central. The dollar will be affected today by the announcement of durable goods orders and weekly jobless claims.