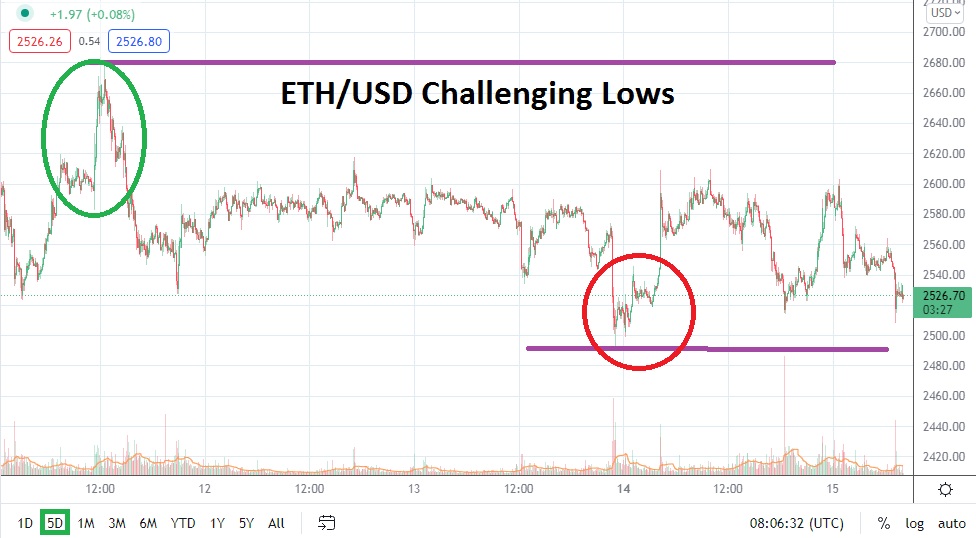

After making a high of nearly 2600.00 yesterday, ETH/USD remains locked in a bearish mode which has seen early selling pressure escalate. ETH/USD is near important short term support levels which are approaching lows that could spark additional nervous selling if proven to be rather weak. The 2500.00 juncture is within sight and if values sink beneath this level and are sustained it would not be a good indication technically.

The last time ETH/USD traded below the 2500.00 with a sustained flurry was on the 8th of March and this was after it had hit the 2450.00 ratio on the 7th of March. Speculative conditions remain rather fragile as the broad cryptocurrency market and global financial assets are all reacting to the vast amount of noise being created in the financial world due to troubling economic outlooks.

However, ETH/USD if it is able to withstand the fresh blows of downward price action being seen today, may be viewed by some bullish speculators as having been oversold. Yet, bullish traders will have to take careful consideration of technical charts which continue to highlight ETH/USD is consistently retracing lower price realms instead of higher achievements. Short term trading is much different than the ability to buy ETH/USD with the ability to hold on for a longer amount of time and seek significant turnarounds regarding value.

With a seemingly menacing degree of nervousness in the broad cryptocurrency markets, speculators who remain bearish and want to sell cannot be faulted. If downside pressure continues to demonstrate strength and the 2500.00 punctures lower, some traders may target the 2485.00 mark as a goal. Traders are reminded not to become overly confident and overly ambitious. ETH/USD has the capability to reverse higher with lightning speed. Risk management is going to be important and within the existing nervous markets being seen now, stop loss protection is certainly urged.

Some traders may want to speculate on upside price action, but if they take this trading route they may want to cash out quick hitting trades using take profit orders. ETH/USD has been within a rather significant bearish mode for the past five months and this may not be about to change near term. If Ethereum continues to display a lower sentiment, speculators who sell ETH/USD cannot be faulted for seeking lower values.

Ethereum Short-Term Outlook

Current Resistance: 2566.00

Current Support: 2485.00

High Target: 2616.00

Low Target: 2410.00