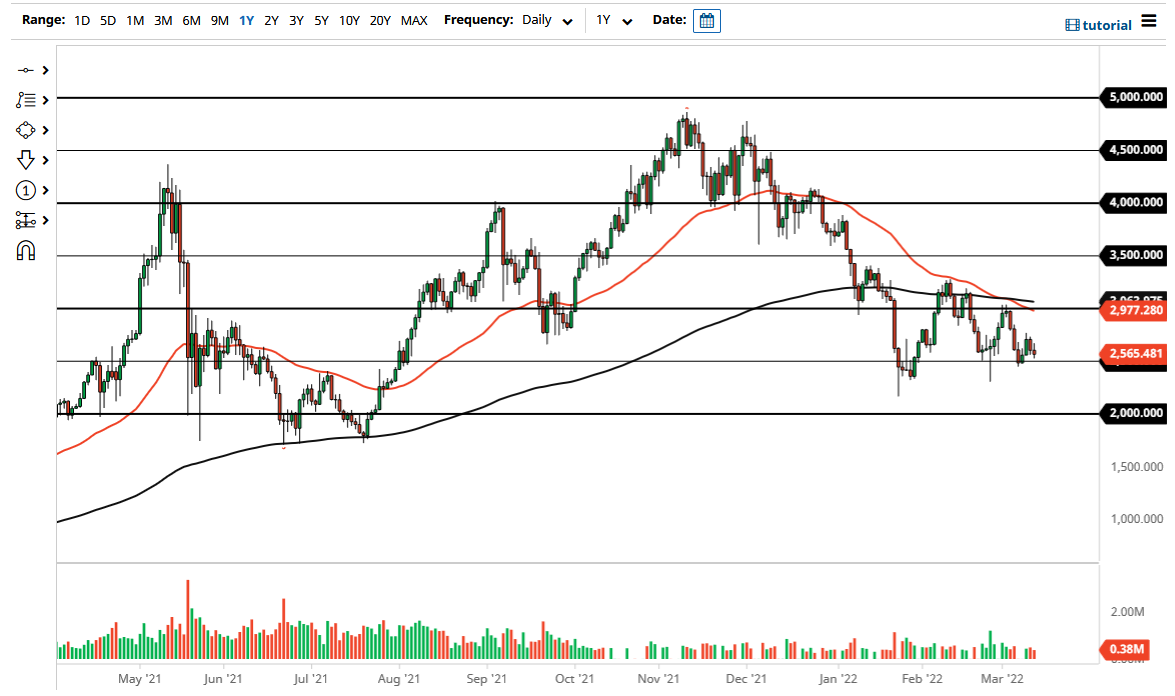

The Ethereum market rallied initially on Friday but gave back the gains to show somewhat weak price action. The $2500 level underneath continues to be important, and I think it will offer a significant amount of support. I fully anticipate that the market may test that region in order to see whether or not it can break down below it. That is a region of support that I think extends down to the $2400 level, so it is going to take a significant amount of work to break down through there.

With that being said, it does not necessarily mean that we cannot do it, just that it may take some effort. The market has been a bit of a mess for a while, and we recently had that “death cross”, when the 50-day EMA crosses below the 200-day EMA. The indicator tends to be a little bit late, but it is something that will attract a certain amount of attention anyway.

On the upside, if we were to break above the $2750 level, it could open up a move towards the $3000 level. Breaking above the $3000 level then could be up significant signal to start going long. In general, this is a market that I think is going to continue to struggle and I am starting to believe that we are going to go into a “crypto winter”, which is when markets do very little and simply grind sideways for what seems like a lifetime. This is generally after a massive selloff, and that is most certainly something that we have seen around the crypto markets.

Ethereum is plagued at the moment by a delay in the so-called “Ethereum 2.0” release. People are starting to get a little bit impatient, but the fact that we have a tight monetary policy in the United States does no favors either. After all, the crypto markets are far out on the risk appetite spectrum, so it is going to take a very loose monetary policy to make that attract as much trading capital as it would from institutions over the last couple of years. In general, you can also make an argument that we are forming a descending triangle still, and if we break down below the support level, we could very well slice through the $2000 level eventually.