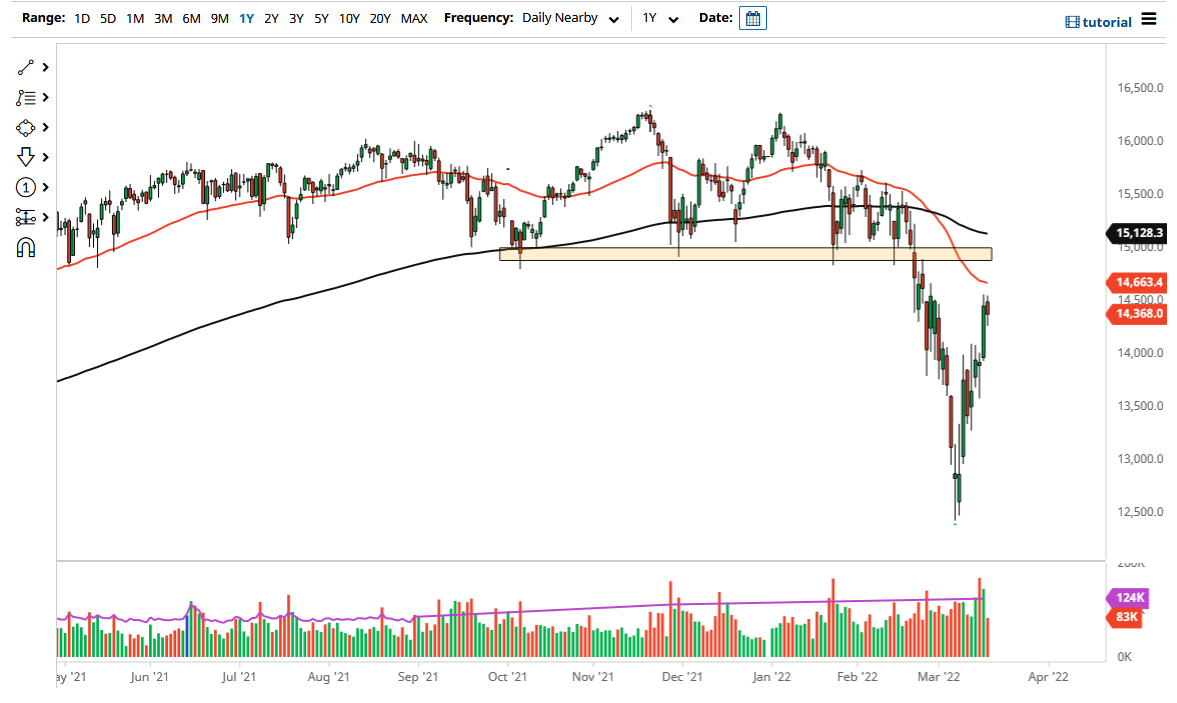

The DAX has initially tried to rally during the trading session on Thursday but has found the €14,500 level to be difficult to overcome. We have fallen from there and now it looks as if the market may be trying to decide whether or not it can continue to go higher as we have bounced far too quickly from the bottom. Ultimately, the market collapsed and then bounced. The market has been so out of control lately that sooner or later the momentum has to stop.

If we break down below the bottom of the candlestick for the trading session on Thursday, as likely that the market goes look towards the €14,000 level. If we break down below there, then it is likely that we go looking towards the €13,500 level after that. Longer-term, I would not be surprised at all to see this index test the lows, but obviously, anything is possible in this type of situation.

The fact that we could go nowhere after the massive and impulsive candlestick during the previous session suggests that we are struggling. The €15,000 level above would be the next target if we go higher, as it was previous support and therefore a certain amount of “market memory” comes into the picture. The downtrend was there for a reason, and those concerns in the European Union are going away anytime soon.

I think the only thing that you can count on in the DAX right now is a lot of volatility, and therefore you need to be cautious with your position size because losses can pile up rather quickly if you are not careful. The DAX of course is highly sensitive to any idea of exports, due to the fact that so many multinational conglomerates are part of the index. The rest of the world is in the process of slowing down, so it certainly makes sense that the DAX will fall right along with it. It is a situation where I am waiting for signs of exhaustion to short or break down below the lows of the session that we just printed on Thursday. Again, be cautious with your position size, which of course is something that you should do with any market in this type of environment as there is so much risk out there.