The German DAX index initially gapped higher to kick off the week in the futures market on Monday, as it started to look like the traders were looking to take advantage of more of a “risk-on” type of situation. The market has shown itself to see hesitation though, and by the time we reached the highs from the Friday session, sellers came in and pushed the market lower.

Now that we have formed a shooting star just as we had on Friday, it shows just how resistive the €14,000 level is going to be, and that is the short-term “ceiling in the market” going forward, so I think that the market is going to look at that as a very difficult barrier. Because of this, the index is likely to see plenty of selling pressure if we can break down below the lows of the trading session on Monday, which would simply be a bit of a continuation of the downtrend that we have been in. Furthermore, it is worth noting that the market is pulling back from roughly the 50% Fibonacci retracement level.

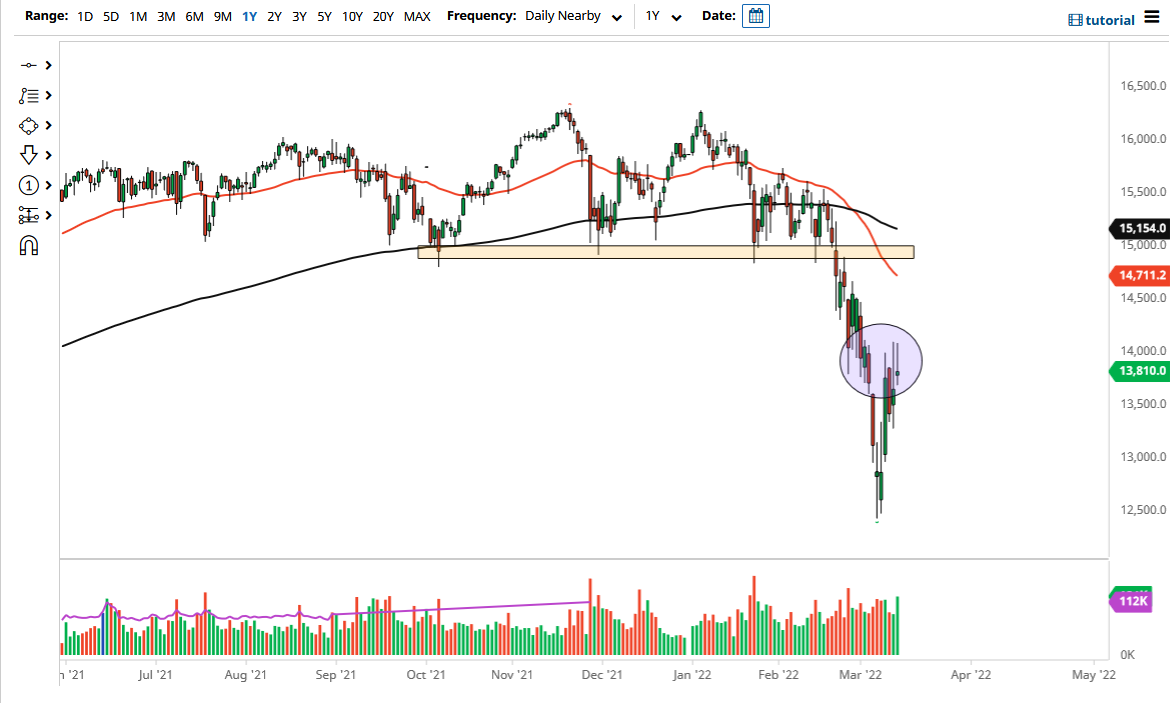

You will notice that I have a purple circle on the chart in this general vicinity because it is a crucial area, not only due to the 50% Fibonacci retracement level, but also the fact that there is a cluster of noise in that general vicinity. The downside opens up the possibility of a move towards the €13,000 level, perhaps down to the €12,500 level to retest the bottom.

If we were to break down below the recent bottom, the market could go looking towards the €10,000 level. This would obviously represent a very significant breakdown in the market and would probably be accompanied by quite a bit of selling pressure in other indices as well. Keep in mind that there are plenty of negative influences out there that could continue to weigh upon the market. Inflation is a major issue, but it is also worth noting that the market is going to have to pay attention to geopolitics, as Ukraine is currently in a war with Russia, and of course, the DAX is highly sensitive to anything that goes on in the continent. Ultimately, this is a market that will continues to see downward pressure going forward.