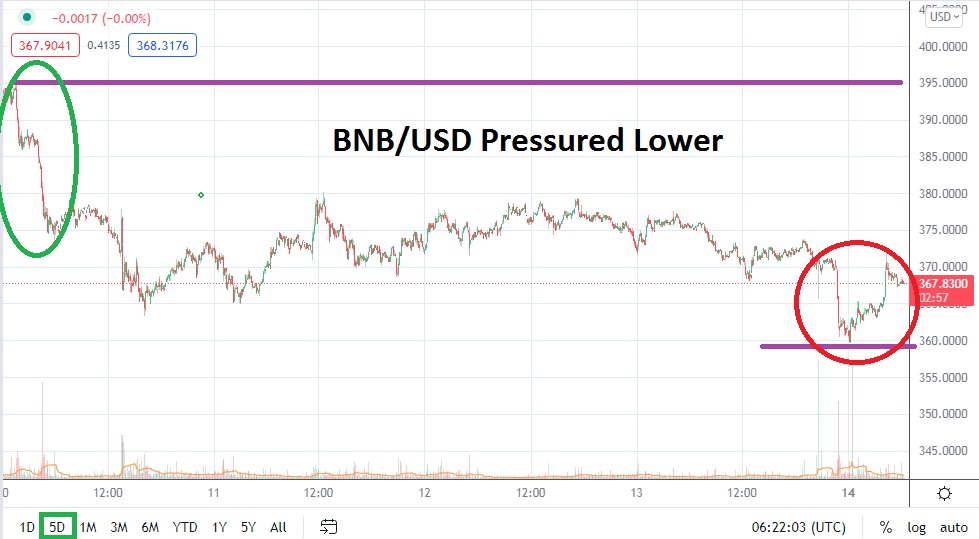

BNB/USD did see a flourish of whipsaw trading yesterday as it touched the 360.0000 mark momentarily, but then moved towards the 371.0000 only a handful of hours later. BNB/USD remains under pressure like the broad cryptocurrency market as speculators react to nervous conditions which are affecting all financial assets. Binance Coin is a solid barometer of the overall digital assets because of its very real connection to the Binance exchange, which serves as a major gateway to the cryptocurrency world for speculators.

As of this writing, BNB/USD is trading above the 368.0000 level, but its value is moving fast and traders are highly encouraged to make sure they are monitoring conditions as they use entry price orders to engage with their speculative wagers. Support levels which can be deemed as important are close by around the 367.0000 mark, if they prove vulnerable this could set off another wave of selling within BNB/USD. Binance Coin can move fast, if this support level falters traders are reminded that yesterday’s lows fell below the 360.0000 mark, which hadn’t been seen since the 27th of February.

The weakness in the broad cryptocurrency market is a warning sign for all speculators. Optimistic bullish traders may see BNB/USD as oversold, but they would likely be hard pressed to suggest a sustained higher move can be demonstrated near term. Perspectives matter, yes, reversals higher will certainly be seen, but the question is how long the moves upward can be maintained. On the 1st of March BNB/USD was trading near 425.0000. On the 9th of March BNB/USD was trading near 402.0000.

If broad cryptocurrency market price action remains nervous and headwinds are strong near term, there is reason to suspect BNB/USD could test lows again. If important short term support realms falter and the 365.0000 mark suddenly appear, traders cannot be faulted for believing additional downside momentum could escalate. Traders need to use their risk management effectively if they decide to wager on further lower moves.

Selling BNB/USD and aiming for nearby support levels with realistic targets is a logical choice. The broad cryptocurrency market is likely to remain volatile near term as speculators react to nervous trading conditions which are igniting fast moves in all financial assets. BNB/USD is a sincere speculative asset which can produce dynamic results. If downside price action is displayed, a retest of lows seen yesterday could be exhibited.

Binance Coin Short-Term Outlook

Current Resistance: 370.7500

Current Support: 367.1500

High Target: 378.9000

Low Target: 358.2500