Last Thursday’s signals were not triggered, as none of the key support or resistance levels were reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken before 5pm Tokyo time Wednesday.

Short Trade Ideas

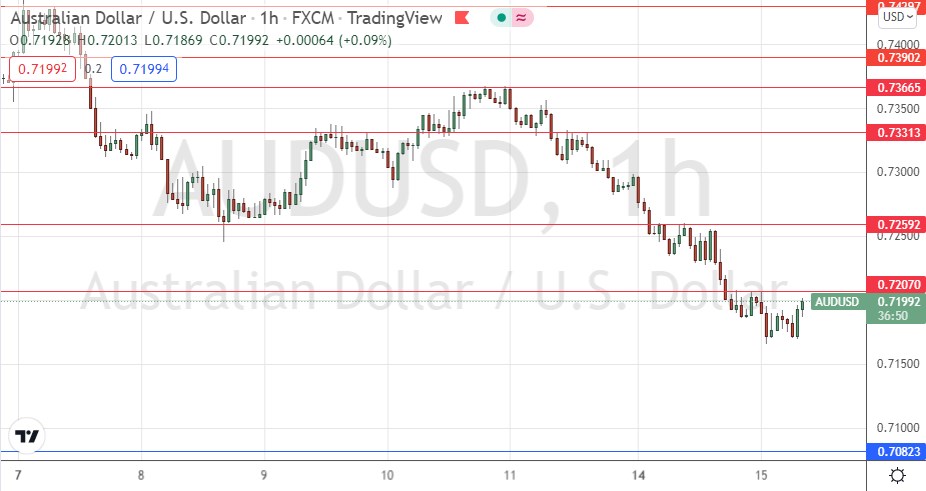

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7207 or 0.7259.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7082.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that I was prepared to take a long trade from a bullish bounce at 0.7288, and that in addition to my key levels (which were not reached) I thought there might be minor resistance at 0.7350. Neither of the key levels were reached.

The technical picture is considerably more bearish now, as we see risk assets such as stocks and the Australian Dollar hit by fears over inflation, the outside chance of a 0.50% rate hike by the US Federal Reserve tomorrow, coronavirus lockdowns in China, and the continuing war in Ukraine which has no end in sight.

The Reserve Bank of Australia released the minutes of its most recent meeting a few hours ago, which contained no real surprises, just the expected pessimistic inflation outlook. The release did not really affect the price of the AUD, but it is certainly not going to boost it.

The price has moved down decisively and printed new lower resistance levels, although the fall has halted. The price is now consolidating just below the resistance level at 0.7207.

Given the generally bearish environment for the AUD and the long-term strength in the US Dollar, I will be happy to take a short trade from a bearish reversal at either 0.7207 or 0.7259 if either trade sets up today.

Concerning the USD, there will be a release of PPI data at 12:30pm London time. There is nothing of high importance due today regarding the AUD.

Concerning the USD, there will be a release of PPI data at 12:30pm London time. There is nothing of high importance due today regarding the AUD.