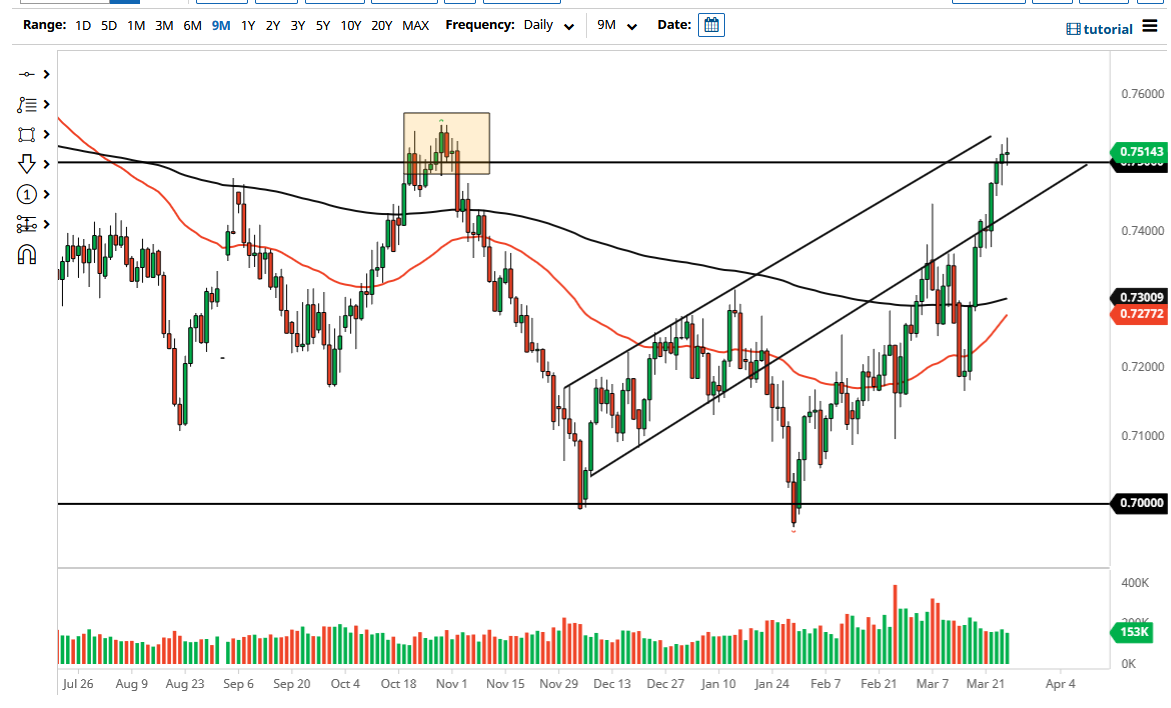

The Australian dollar went back and forth on Friday, as we are hesitating just above the crucial 0.75 handle. If you look to the left, you will see that in the past there has been a significant amount of noise just above this crucial level, so it should not be a huge surprise to see that the market was not able to simply slice through all of it.

That being said, it will be very interesting to see how this plays out on Monday because there may have been a little bit of profit-taking heading into the weekend. As we are sitting right at the top of the range, one would have to assume that there is a reasonable chance that we get a pullback. That pullback will more likely than not attract value hunters, especially near the 0.74 handle. However, if we were to break down below the 0.74 level, then we may have a bit of follow-through to the downside.

While I am not advocating shorting the Australian dollar quite yet, this is a very interesting place to run out of momentum. This either means that the run is over, or we need to pull back to pick up enough momentum to smash through resistance.

However, if we were to break above the 0.76 level, then the Australian dollar becomes more of a “buy-and-hold” asset, allowing the market to go much higher, perhaps as high as the 0.78 level. I do not think that we are likely to see that happen easily, mainly because we have seen an attempt to do exactly that over the last 48 hours. Keep in mind that the Australian dollar does have a little bit of an advantage over a lot of other currencies, as it is so heavily correlated to commodities.

Commodities have been very bullish for quite some time, so I think that the markets could be running out of momentum at the same time. We will have to wait and see how this plays out, but certainly, it looks as if we are more likely than not going to see a pullback. If you are a short-term trader, it may be something you can take advantage of, but for those that are more apt to be swing traders, it will be but a bump along the road.