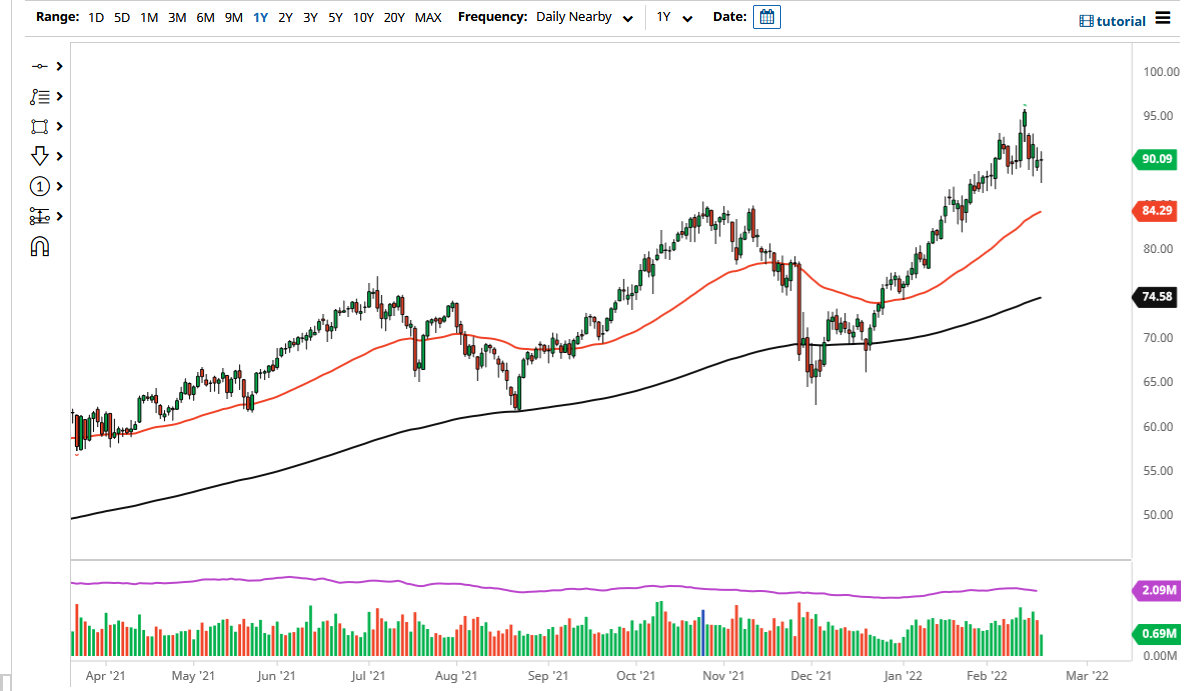

The West Texas Intermediate Crude Oil market has initially pulled back during the trading session on Friday to test the $90 level, but we have turned right back around and form a hammer. This suggests that we are in fact looking for the possibility of a bounce. That being said, the market looks resilient, so I think at this point in time we are more than likely going to see a little bit of back-and-forth, as we try to work off some of the massive froth from the shot higher that we have seen over the last several months.

I think we continue to go higher over the longer term, and of course a lot of geopolitical concerns will continue to be what people are paying attention to. This is a market that if we were to break down below the bottom of the hammer, that could open up fresh selling in a retest the 50 day EMA. But at this point in time, that seems to be very unlikely to happen so therefore I think what we have a situation where you buy short-term dips if you get the opportunity. I would not be surprised at all to see the market go looking towards the $95 level above, where we had pulled back from.

The US dollar can have a bit of an influence on the crude oil market, but I think at this point in time there are two major things that you should be paying attention to, neither which have anything to do with the greenback. The first one of course is the nonsense going on at the Ukraine border with the Russians, which of course has major geopolitical ramifications.

The next of course is the fact that we had spent quite a bit of time not drilling for oil during the pandemic, so that has ramifications later on down the road. At this point, we are later on down the road. As economies reopen, demand for energy was always going to be an issue, and now we are at the point where supply is struggling to keep up. Because of this, it becomes a simple supply and demand equation, and we should continue to go looking towards the $100 level over the next several months.