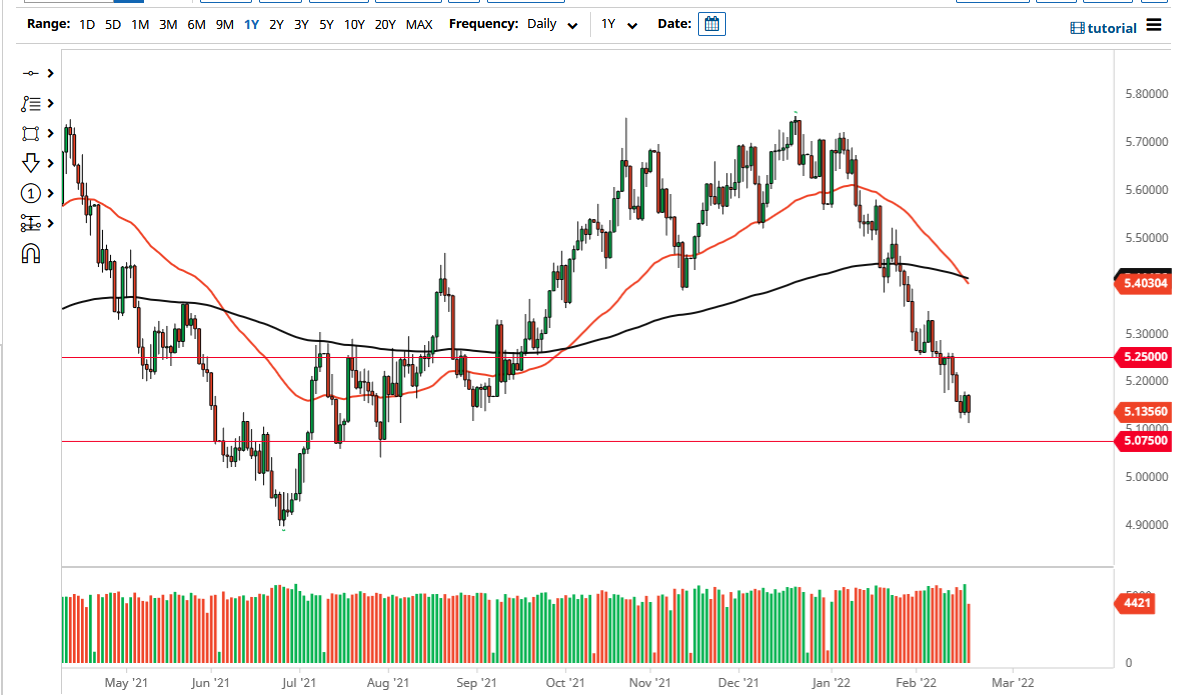

The Brazilian real continues to show signs of strength against the greenback, as we have seen the USD/BRL pair reach towards the 5.12 level. This is a market that just formed the so-called “death cross”, so longer-term traders will probably be looking at that as a potential signal as well. That being said, it is likely going to be a scenario where we will continue to see a “fade the rallies” type of situation.

In fact, I do not know when I would be a buyer, but I know it would have to be at least above the 5.25 handle, and perhaps have something to do with a major “risk off” type of situation globally. The US dollar would be much more attractive to traders than the Brazilian real, but it must be noted that the interest rate differential continues to see a favorable move in the direction of Brazil.

In general, this is a market that I think will continue to see a lot of choppy behavior, but I also believe that it is probably only a matter of time before the buyers at least have to come back and make an attempt to get to the upside. The 5.07 level is an area that I will be paying attention to underneath as the scene of a potential bounce, but we still have to get there first. It is worth noting that we have seen a little bit of buying pressure in this pair, perhaps either closing out positions to flatten the books into the weekend, or perhaps a situation where we are trying to avoid risk heading into what could be a very dangerous week.

Keep in mind that the Brazilian real is highly sensitive to the commodity markets, especially agricultural commodities and others like sugar. That being said, we have seen sugar markets change in attitude, and it could suggest that we are going to continue to see a lot of push and pull as to where we are getting ready to go on the risk spectrum here. The one thing that I would say that sellers have to be aware of is the fact that we are quite overstretched at this point. With that in mind, caution is warranted, but clearly it is easier to go short than it is to go long.