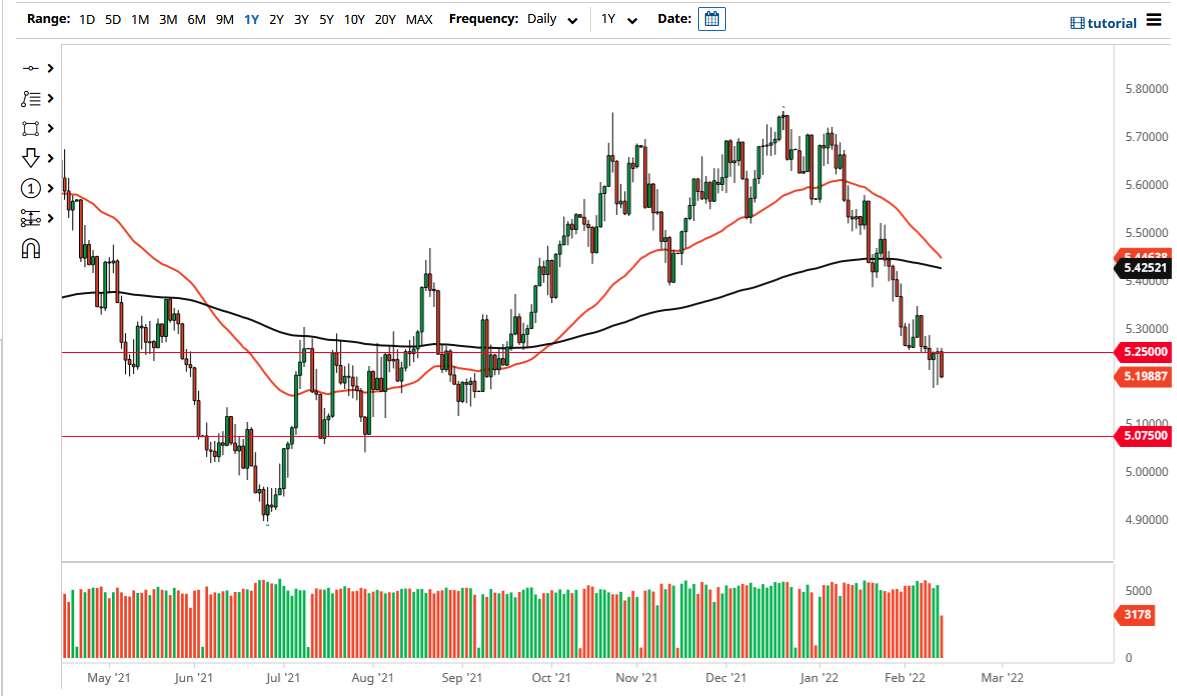

The US dollar fell against the Brazilian real on Monday, as it looks like we are hell-bent on trying to test the support level. This is a market that I think will eventually see a continuation of the overall downtrend. What I find interesting is that we had fallen rather hard over the last couple of days, but now it looks as if the losses are trying to stick. If we can break down below those couple of hammers near the 5.18 BRL level, then it is very likely that we could go looking towards 5.07 underneath.

Keep in mind that this is an emerging market currency, so it does have its own concerns. Commodity pricing of agricultural goods, especially sugar and coffee, should be followed as well. They do seem to be picking up a little bit as inflation does, so it will be interesting to see if that follows through into this market. You can also make an argument for the 50 day EMA getting ready to cross below the 200 day EMA as it is the so-called “death cross”, but quite frankly that indicator is almost always late, so I do not put that much faith in it.

The alternate scenario is that we turn around and recapture the 5.30 level. If we did, that might be just enough effort to turn this thing around and have it go higher. At that point, it would more than likely have something to do with a major “risk off scenario” that had picked up momentum. Things are quite dicey at the moment anyway, so this should not be a huge surprise if it does in fact happen. However, when I look at the chart right now it does not look very likely to be the next move.

Emerging market currencies are always a bit tricky because they have a lot of interest rate differential attached to them. As it favors Brazil at the moment, it appears that might be part of what traders are chasing. If that is going to continue to be the case, then it will favor Brazil much more than it will favor the United States, despite the fact that yields are spiking in America. With this, it looks as if we have further to go.