The US dollar was subjected to selling operations recently to take profits after its sharp gains due to the expectations of raising US interest rates, which allowed the gold market to recover yesterday. The price of an ounce of gold recorded the level of 1808 dollars and the price of gold settled around the level of 1797 dollars per ounce. Traders are now looking forward to the monetary policy meetings by the Bank of England and the European Central Bank are absorbing the Australian Central Bank policy announcement.

Investors also reacted to comments from some Federal Reserve officials about possible policy moves by the central bank. The Kansas City Fed President, Esther George, said a large balance sheet cut could allow the Fed to pursue a less aggressive strategy about short-term interest rates.

Separately, San Francisco Fed President Mary Daly said policy moves "should be gradual, not destructive." Accordingly, the US Dollar Index DXY drifted to 96.24 before rising to 96.39 and regaining some of its lost gains. However, the index is down 0.14% from the previous close.

In US economic news, the Institute for Supply Management released a report showing the continued slowdown in US manufacturing activity growth in January. Accordingly, the ISM said that the manufacturing PMI fell to a reading of 57.6 in January from a revised 58.8 in December, although the reading above the 50 level still indicates growth in the sector. The index fell for the third month in a row, falling to its lowest level in more than a year.

Economists had expected the manufacturing PMI to fall to 57.5 from 58.7 originally recorded for the previous month.

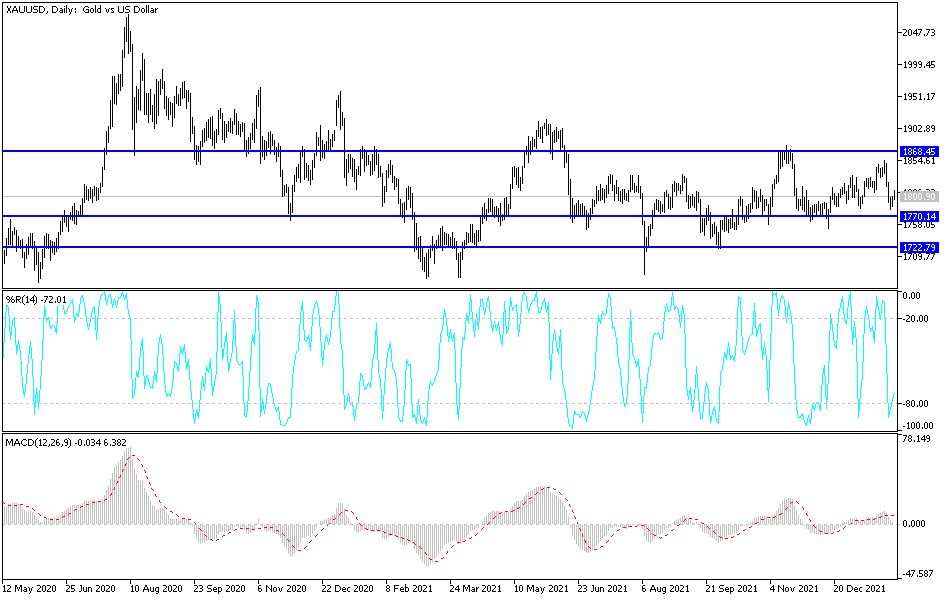

According to gold technical analysis: There is no change in my view of the price of an ounce of gold, it may move in narrow ranges with an opportunity to rebound higher, but with caution until the announcement of the US job numbers and the passage of the reaction from the announcement of monetary policy decisions for both the Bank of England and the European Central Bank. The expected trading vicinity of the gold price is $1818 and $1788. As I mentioned before, price stability will remain above the psychological resistance of 1800 dollars, which is important to the extent and strength of the bulls' control over performance.

I still prefer buying gold from every bearish level.