The gold market held on to gains, recovering from last week's sharp drop that came on the heels of an upbeat turnaround from the Federal Reserve.

The market now awaits new evidence on inflation expectations. The price of gold is now stable around the level of 1803 dollars an ounce at the time of writing the analysis, waiting for any news regarding the policies of the global central banks.

On Monday, US Federal Reserve officials stressed that they want to avoid unnecessary disruptions to the US economy as they prepare to start raising interest rates, suggesting a waning appetite for a strong move of 50 basis points in March. Therefore, markets will closely watch the US jobs report for January, on Friday, for clues on the path of inflation. After dropping 2.4% last week, the biggest weekly drop since August, it rose 0.3% on Monday.

According to the metals market, the spot gold price changed slightly, silver was also stable, platinum rose slightly, while palladium declined. Markets in China and some other Asian countries will be closed most days of the week for the Lunar New Year holiday.

A senior gold mining executive sees the potential for a record year of mergers and acquisitions as companies turn to deals to boost production at a time when bullion prices are rising.

OECD Secretary-General Matthias Kormann said the OECD expects global inflation to slow in the next year or two as central banks raise interest rates and supply disruptions linked to the pandemic fade. “We believe that over the next 12 to 18 months there will be an easing of inflationary pressures,” Corman said during a video conference after the Organization for Economic Co-operation and Development released its Economic Survey for New Zealand on Tuesday in Wellington. Gradual financial support at the level of the crisis, but on top of that there will be a rebalancing of the global supply and demand equation.”

He said that while the spread of the omicron variant of Covid-19 will have an impact on growth prospects, the global economy is well positioned to deal with it.

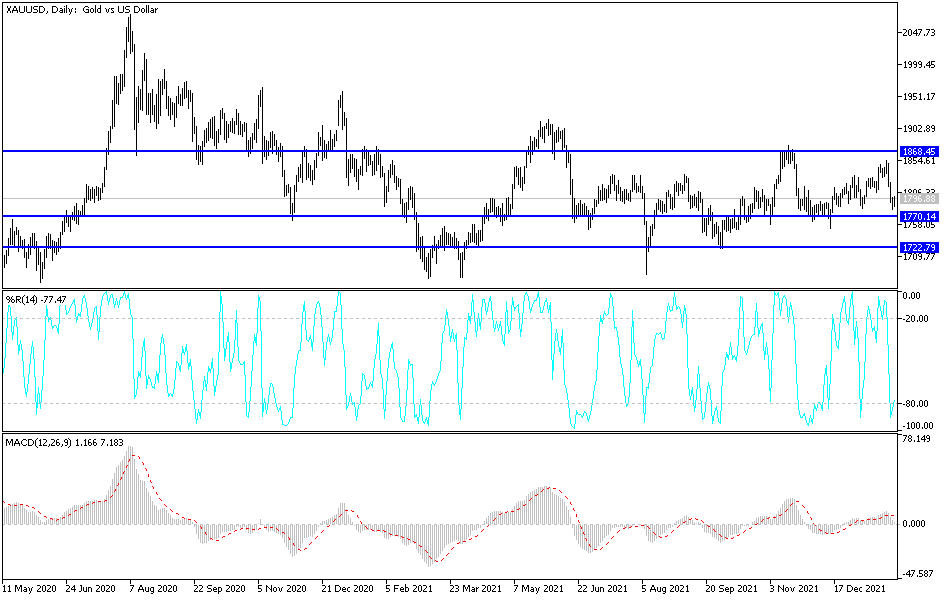

According to gold technical analysis: I still see that stability above the psychological resistance of 1800 dollars an ounce supports the bulls in moving the price of gold to stronger ascending levels, and the closest ones after that are 1818, 1827 and 1845 dollars, respectively. This path may collide with selling with the upside if the global central banks continue to give signals for more rate hikes during the year. Other factors for gold's gains are in place, such as the pandemic and geopolitical tensions.