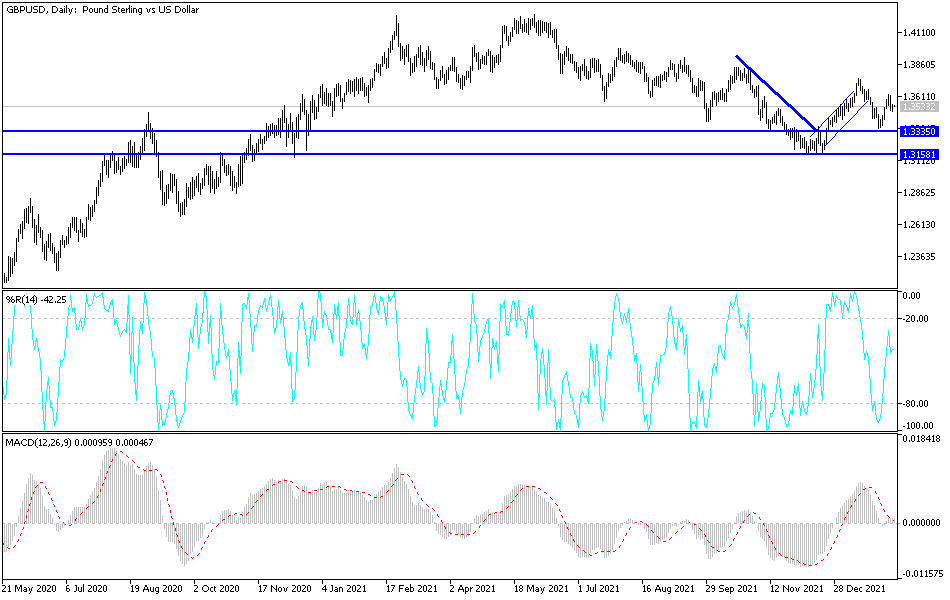

For the second day in a row, the price of the GBP/USD currency pair is subjected to profit-taking operations after its strong gains recently, reaching the resistance level 1.3628. The selling operations pushed the currency pair towards the support level 1.3490 before settling around the 1.3540 level at the time of writing the analysis. The selling came amid strong gains in the US jobs numbers, which came in stronger than all expectations. In addition to a temporary halt to the pace of optimism about the future of raising interest rates from the Bank of England. In general, the pound may risk more losses in the coming days if the latest US inflation data leads to a continuation of the dollar's attempt to gain more momentum towards the future of raising US interest rates.

GBP/USD's recovery from its lows in late January has already stalled after the press conference following the Bank of England monetary policy decision last Thursday. It drew the market's attention to influence the negative effects of some of its recent forecasts. Commenting on the performance, Juan Manuel Herrera, analyst at Scotiabank said: "The British pound initially rose above the $1.36 level and may have continued to consolidate throughout the day into the mid-number area had it not been for Bailey's cautious comments in the press conference following the announcement."

While a recent bank rate increase to 0.50% lifted the British pound, appetite for the British currency subsequently waned after Bank of England Governor Andrew Bailey and his colleagues pointed to recent increases in natural gas and internationally traded commodity prices dampening economic growth outlook. They strongly hinted that market expectations regarding this year's bank interest rates are likely to be excessive because they may lead to a drop in inflation below the target level in the coming years.

Sterling's price gains quickly stalled in the aftermath of last Thursday's press conference. This week will likely pay close attention to remarks made by BoE Chief Economist Howe Bell at Wednesday's online event with the Association of Professional Economists and Governor Andrew Bailey on Thursday. This event is considered the highlight of the week for the British Pound, ahead of the British GDP data on Friday.

While economists will look at Friday's estimate of UK GDP for December and the fourth quarter of 2021 to understand the impact of the November outbreak of the Omicron strain of coronavirus on the economy, on Wednesday it is likely that US inflation figures for January will be released which will have a greater impact on the pound rate against the dollar.

Despite the recent performance, the price of the GBP/USD currency pair still has the chance of a bullish rebound as long as it is stable around and above the 1.3500 resistance that supports the bulls to move higher. The price of the currency pair may remain in narrow ranges until the announcement of the data and events listed above. The control of the bulls will get stronger if the currency pair moves towards the resistance levels 1.3585, 1.3660 and 1.3720, respectively.

On the other hand, according to the performance on the daily chart, the sterling-dollar pair may abandon the bullish view if it returns to the 1.3360 support area. Expectations of raising interest rates for both the Bank of England and the Federal Reserve may create a balance for the performance of the pair.