The EURUSD price regained the 1.12 resistance at the beginning of this week's trading, but a close group of technical resistance on the charts and the imminent monetary policy decision of the European Central Bank (ECB) may leave the single European currency struggling to maintain its recovery later this week.

The rebound gains for the EUR/USD pair reached the resistance level of 1.1278, which is stable near it at the time of writing the analysis. This cautious rebound comes before important and influential events and data that may constitute the closing of the pair's trading for this week.

The European single currency has set itself on a temporary path to achieve triple gains against the dollar in an ongoing attempt to offset losses incurred in the wake of the Federal Reserve's monetary policy decision last Wednesday. The EUR/USD rate fell to an 18-month low around 1.1120 after Federal Reserve Chairman Jerome Powell suggested that US interest rates could be raised in March and that they could rise faster and more than the market currently expects if inflation continues.

“Break the EUR/USD upper side at 1.12 would be the first sign to watch for a possible reversal of euro losses,” warned Juan Manuel Herrera, strategist at Scotiabank, in a research note. “Markets may be encouraged by the 5% handle of German inflation to continue betting on rate hikes this year,” the analyst added. We believe this is highly unlikely and the Bank will continue to indicate its expectation that inflation will slow below target."

While US dollar prices fell broadly earlier this week, likely explaining much of the rally in the EUR/USD pair, preliminary inflation data out of Germany has sparked interest in the Euro due to its content and release near the policy decision European Central Bank on Thursday.

Statistics agency Destatis figures showed that the national measure of annual inflation fell from 5.3% to 4.9% but remained close to its highest since the early 1990s despite dissipating the effects of the statistical base that artificially inflated price pressures last year. For his part, ECB Chief Economist Philip Lane said: “We must think of these pandemic years, 2020, 2021 and 2022 as part of the pandemic cycle. In the first year of 2020, inflation was relatively low. In the second half of 2021, inflation turned out to be very high. And then, as we look at this year, 2022, we think inflation will remain high at the beginning of this year, but will decrease later this year, especially towards the end of the year.”

"We are clear from our December forecast that we expect inflation - in total terms for this year - to be around 3.2 per cent in the euro area, then to be less than 2 per cent in 2023 and 2024. A significant drop," the official added. "We'll see exactly when and how quickly inflation will fall."

Part of the market is likely to see German inflation figures as supporting the notion that this year the European Central Bank may withdraw more extraordinary stimulus to the Eurozone economy. Pricing in interest rate markets suggests that investors see that the ECB is likely to start raising the deposit rate from -0.50% before the end of the year, although the ECB has repeatedly rejected such forecasts, and it is likely that this will be the case. supportive of the euro.

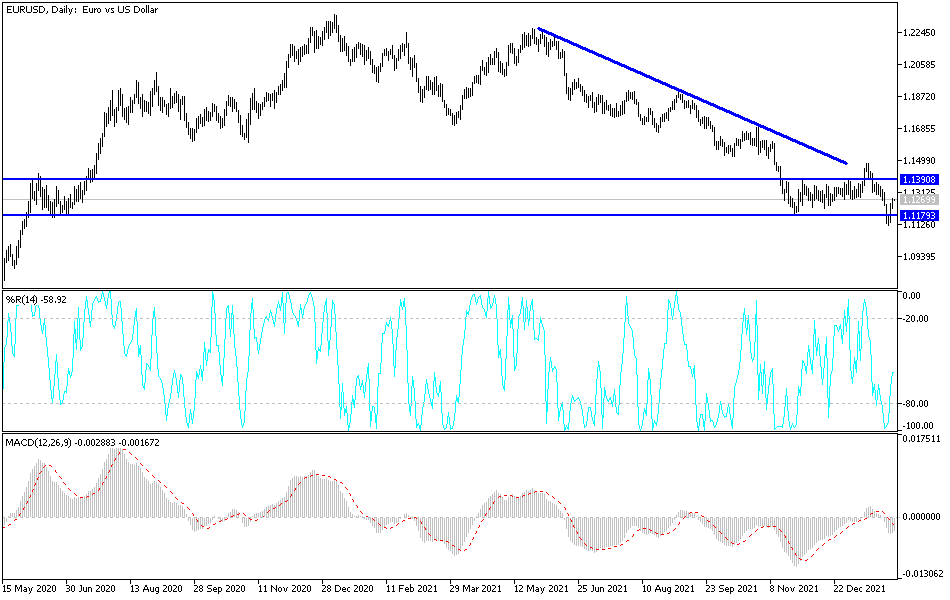

According to the technical analysis of the pair: Despite the recent rebound attempts, the price of the EUR/USD currency pair is still within a bearish channel, the most prominent on the daily chart below. The return of stability below the 1.1200 support will support the strength and control of the bears to launch towards stronger bearish levels. The bearish expectations still indicate to psychological support 1.1000. The opportunity for an upward rebound will be stronger if the currency pair moves towards the resistance levels 1.1365 and 1.1445, respectively.

The euro will interact with the announcement of inflation figures in the euro area and the US dollar will interact with the first data related to the US labor market through the ADP survey of the change in US non-farm payroll numbers.