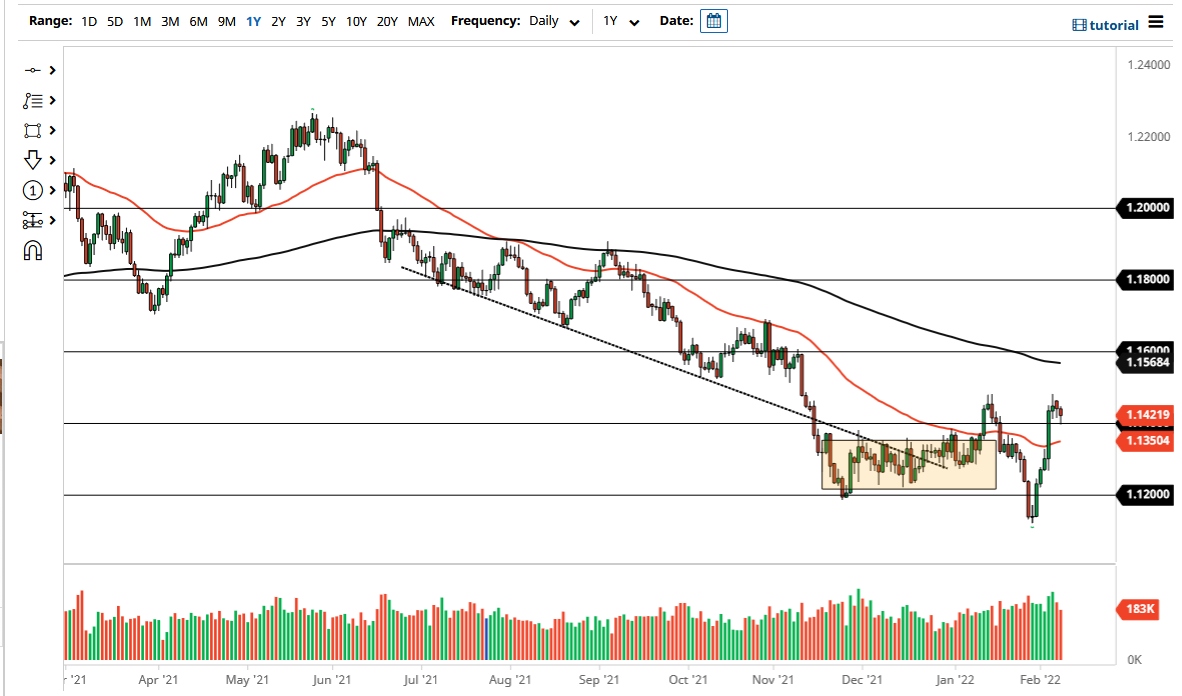

The euro fell a bit on Tuesday to test the 1.14 level before turning around and showing signs of life. Because of this, the market is very likely to continue seeing a lot of noisy behavior, as the euro recently got a bit of a boost due to the fact that the ECB sounded quite a bit more hawkish after the meeting last week. However, we had also heard several of the central bank governors suggest during the day on Tuesday that the markets are pricing in two interest rate hikes as being excessive, as they sounded quite dovish. That is what initially pushed the euro down to the 1.14 handle.

At this point, if we can break down below the 1.14 level, then it is likely that we will continue to see the euro drop towards the 50 day EMA, but I think at this point in time we are more than likely going to see a little bit of a push back to the upside. If we break down below there, then it is likely that the market could go much lower. At that point in time, we could see a move towards the 1.12 handle. With this being the case, I think that we have to pay close attention to the next couple of days, but it is worth noting that the CPI numbers will be coming out on Thursday, and it will have a direct influence on what happens with the US dollar, and in turn have a major influence on what happens here.

Keep in mind that this market does tend to grind back and forth, so now the question is whether or not we are forming some type of larger consolidation area. On the other hand, if we break above the 1.15 level, then it is likely that we could go looking towards the 1.16 level above, where there has been a thick “resistance barrier” between the 1.15 handle and the 1.16 handle for some time. Looking at this market, I think the next couple of days are ikely to be noisy, so short-term back-and-forth trading is probably more likely than not going to be what we see. Because of this, I would not put a huge position on right now, but as soon as we break in one direction or the other I have some targets.