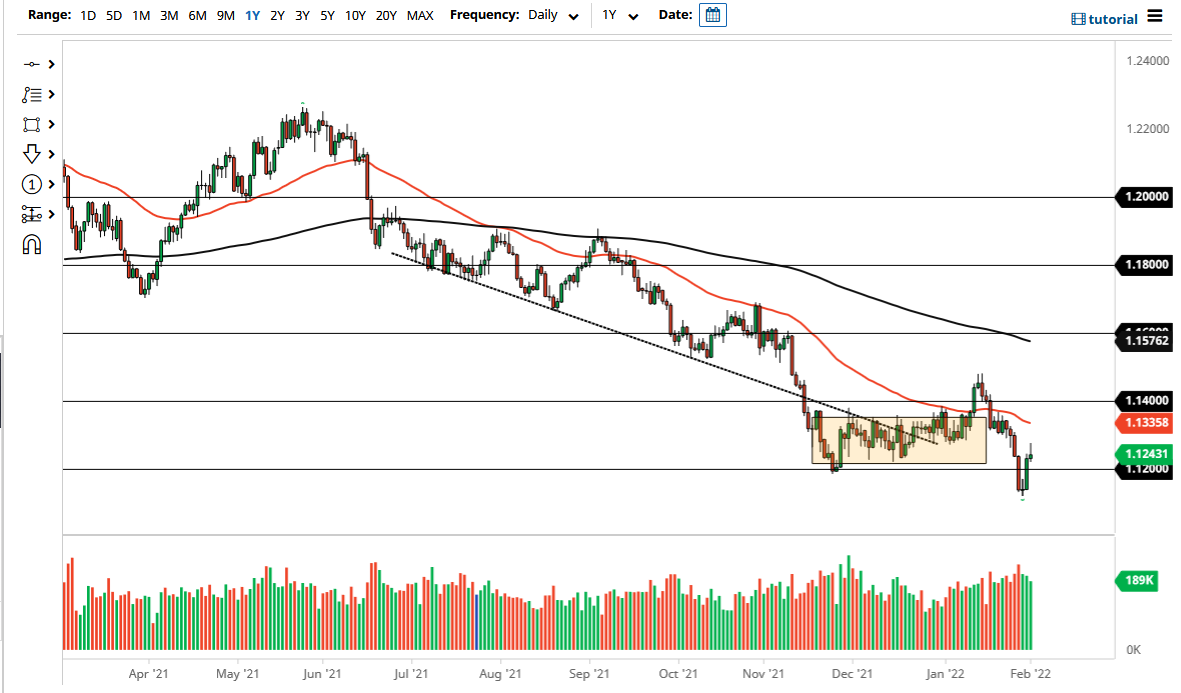

The euro rallied a bit on Tuesday but also pulled back a bit as the market seems a little less confident about the upside than it did just 24 hours ago. After all, we are in a major downtrend and that has not changed. The shape of the candlestick is not quite a shooting star, but it certainly suggests the same thing. A breakdown below the bottom of the candlestick would be a very negative sign and could have the euro looking towards the lows again.

Looking at this chart, it certainly looks as if we are continuing to focus on the idea of the European Central Bank being very loose with its monetary policy, while the Federal Reserve is certainly going to be raising interest rates. Whether or not that is enough to continue the downtrend is open for debate, but it certainly looks as if that is the way it is going to be going forward. If we break down below the 1.12 level, I think that the selling pressure will start to intensify.

On the other hand, if we can continue to break higher, the next major battlefield will probably be somewhere near the 50 day EMA. The 50 day EMA currently sits at the 1.1336 level, and if we can break above there, then it is likely that we will go much higher, perhaps towards the 1.14 level and beyond. I do not know that the euro has enough momentum and positivity going for it to make that move happen, but if we suddenly see the US dollar lose strength in general, it is likely that the euro would be one of the major benefactors as it is considered to be the “anti-dollar.”

I think the only thing you can count on is a significant amount of volatility, so you need to be cautious about your position size. The position sizing can be increased once the trade goes in your favor, but I still think that it is much safer to expect this market to drop over the longer term then it is to expect this market to suddenly take off to the upside and buck the massive trend that we had been in.