The Euro initially dipped during the trading session on Thursday as we continue to see shenanigans in the Ukraine border. That being said, there was a bit of a run towards safety, meaning that we sold off the Euro and ran towards the greenback. This is a typical move, and it would make a certain amount of sense that the Euro would be especially sensitive to this situation as it is right on the steps of Europe itself. However, by the end of the day we started seeing buying coming back into the market, so therefore it looks like we are just going to trade on the latest headline.

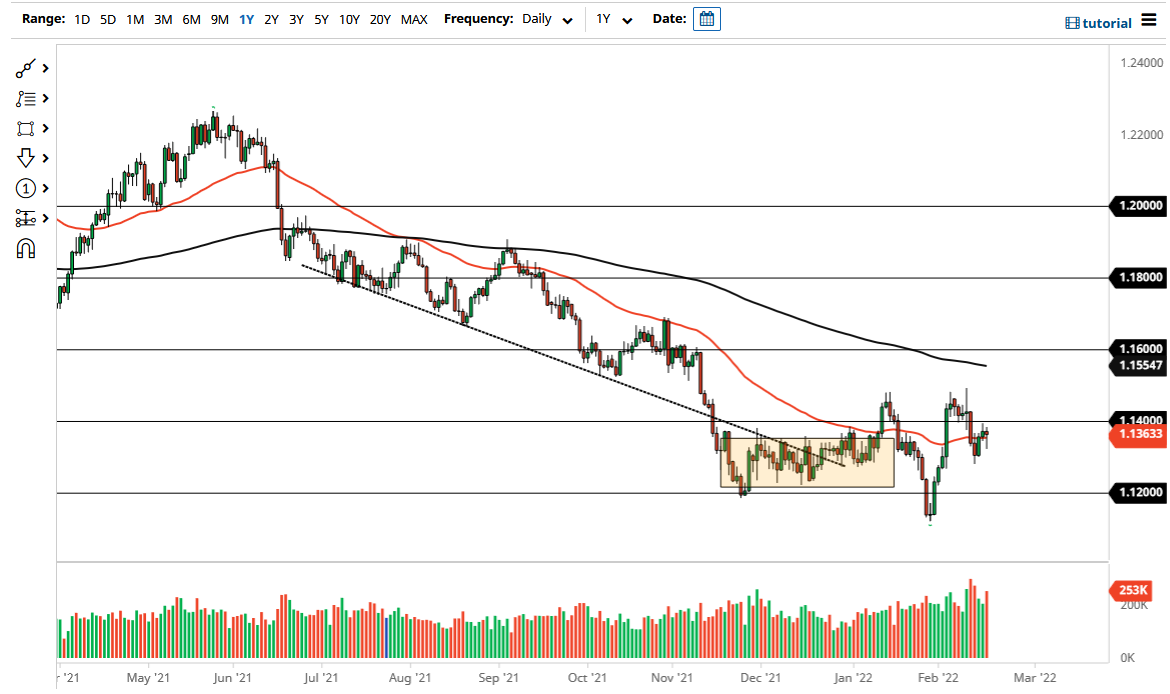

Just above, we have the 1.14 handle coming into the picture and potentially offering resistance, but I do think that it is probably only a matter of time before we see that test it. Whether or not it holds for resistance is a completely different question at this point, but I would point out that there is a thick area of supply all the way to the 1.15 level above, meaning that it might be difficult to break above there for a longer-term move. At this point, that remains to be seen, especially as the area produced a “double top.”

Underneath, if we were to break down below the 1.13 level, it could open up a move down to the 1.12 level given enough time. That is an area that continues to be important from a longer-term perspective from what I can see, and therefore if we broke down below there the bottom would fall out in the Euro, and we could go much lower. This is a market that is trying to turn itself around, but it is obviously got a lot of headwinds just above. In this environment, I think you have to worry about the possibility of the random headline coming out and squashing your trade. It is because of this that I would be very cautious with my position size and would not be very risky at all. Ultimately, I think this is a market that will eventually make some type of decision but right now one has to think of it more or less in the realm of a short-term traders type of environment, because nothing seems to stick for any significant amount of time based upon algorithmic trading.